Trésor-Economics No. 244 - Effects of initial trade tensions between China and the United States

This Eco-Treasury analyses the effects of tariff measures between China and the United States until May 10, 2019. Trade tensions between China and the United States have resulted in a significant and rapid reduction in bilateral trade in surcharged goods. Macroeconomically, China seems to be more penalized than the United States. Globally, the effects of trade tensions are more significant than expected.

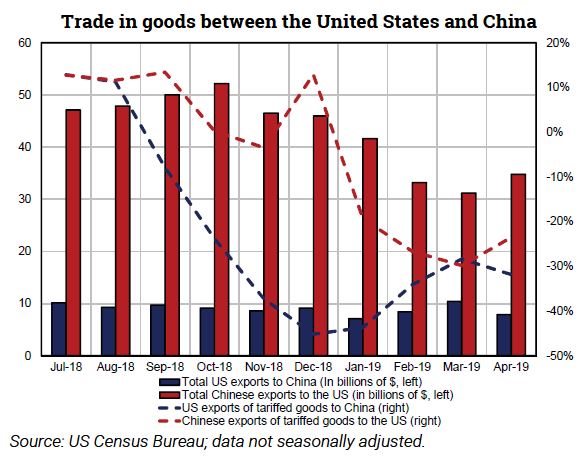

In July, August and September of 2018, the United States successively raised tariffs on a total of $250 billion in annual imports of Chinese goods, stating that it wanted to protect American companies from unfair Chinese practices and reduce the bilateral trade deficit. China responded with tariffs on $110 billion of imports from the United States.

Trade tensions between China and the US have resulted in a significant and rapid reduction in bilateral trade in taxed goods. Chinese imports of US goods subject to tariffs fell, while US imports of Chinese goods for which tariffs had been imposed also fell, but to a lesser extent. The reduction in US imports from China appears to have been accentuated by significant front loading of purchases between the announcement of the measures and their entry into force. At the time of writing, tensions between the US and China have not resulted in a noticeable redirection of demand to other countries, except in certain well-identified sectors (soybeans in particular) or to a few relatively small economies such as Vietnam.

Trade tensions are felt in both countries, but in different ways, with repercussions on foreign trade and domestic demand. The US trade deficit has not been reduced. At this stage, the impact on US growth is not discernible, but tariffs are expected to have inflationary effects on some goods. In China, trade tensions have accentuated the current economic slowdown through lower confidence and have had a negative impact on domestic demand. The contraction in trade flows has affected China's overall foreign trade, and that of its Asian partners. Although domestic demand in both countries has been buoyed by the policy mix, for the time being it is China's economy that seems to be harder hit.

Globally, the initial effects of trade tensions are more significant than had been expected, reflecting the combined effect of lower Chinese demand vis-à-vis its partners and a notable uncertainty shock. Tensions have led to a sharp decline in world trade, although their impact on business activity is, for the moment, moderate.