Trésor-Economics No. 240 - French agriculture and external shocks

French agriculture is constantly responding to external changes in world prices, food preferences, or supportive policies. The Magali 2.0 model makes it possible to estimate the contribution of these shocks to the medium-term evolution of farmers' production and incomes.

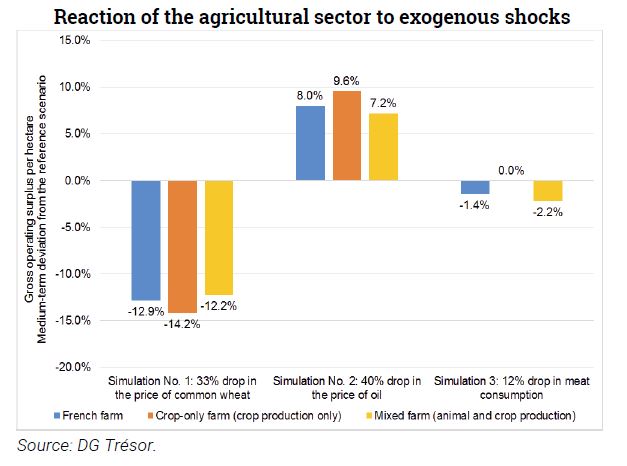

The French agricultural sector is the largest in the European Union. Total production came to €72bn in 2017, of which 57% was crop production (cereals, viticulture, etc.) and 36% animal production (milk, meat, etc.). This sector is particularly exposed to external shocks, climatic shocks (summer droughts in 2015 and 2018, poor spring weather in 2016, a late frost in 2017), economic shocks (prices of animal and vegetable production and agricultural commodities), as well as changes in food preferences (reduced meat consumption). These events affect world prices. Thus, the average price of common wheat can fall by one third for lengthy periods, as was the case between 2011-2013 and 2014-2017.

In addition, the consumption of fossil fuels (fuel oil, diesel and natural gas) and derivatives (nitrogen fertilisers) by agriculture makes it highly dependent on energy prices. Although the sector has benefited from lower oil prices in recent years (from $96 per barrel in 2011-2014 to an average of $58 per barrel in 2015-2018), it remains highly exposed to price increases.

The sector also receives numerous farm subsidies - mainly from the Common Agricultural Policy (CAP) – which amounted to €8 billion in 2017. The amount and distribution of these subsidies could change with the revision of the multiannual financial framework and the CAP for 2021-2027.

The Magali 2.0 is an econometric model allowing to assess the medium-term effects of these various shocks, both actual and potential, on the French agriculture’s production and economic performance. For example, it is estimated that the 12% drop in meat consumption per capita in France between 2007 and 2016 accounted for 0.6% of the decline in permanent grassland areas and was responsible for a 1.4% drop in the gross agricultural surplus in France, particularly in the livestock production sector. The effects of this shock are of course offset or amplified by other shocks that occurred over the same period, such as the fall in oil prices and the fall in common wheat prices (see chart opposite).