Trésor-Economics No. 237 - World economic outlook in spring 2019: Diverging performances in the global slowdown

The global economy showed strong growth again in 2018, with world GDP up 3.7%. However, a slowdown is expected in 2019 and 2020 (world GDP growth seen at 3.4% p.a.), especially in advanced economies.

The euro area's growth rate is set to decline further in 2019. Apart from temporary factors, this is attributable to a slowdow in world demand, considerable uncertainty weighing on investment and consumption, and the end of the post-crisis catch-up effect. In 2019, growth is expected to be particularly lacklustre in Italy (0.2%) and in Germany (0.8%), which are both more affected by these factors than Spain (2.3%) or France. Euro area GDP is seen up 1.3% in 2019, following growth of 2.5% and 1.8%, respectively, in 2017 and 2018. Thereafter, euro area growth is expected to rebound slightly in 2020 (to 1.4 %), as the economies of its major trading partners return to normal and uncertainty levels off.

US economic activity is expected to decelerate slightly in 2019, given pressures on the labour market and the roll-out of protectionist measures, before slowing more substantially in 2020 as fiscal stimulus tapers off. In the United Kingdom, growth is likely to be sluggish, dampened by Brexit-related uncertainty. In Japan, growth is set to be moderate in 2019 due to slowing Chinese demand, followed by even weaker growth in 2020 as VAT is increased.

In the main emerging economies, activity is generally expected to remain upbeat. Growth should be strong in India, but China is set for a soft landing as deleveraging measures and the trade dispute with the United States begin to take a toll. Turkey, which is already in recession, is expected to see its GDP decline in 2019, followed by a recovery in 2020. Both Brazil and Russia should post modest economic recoveries.

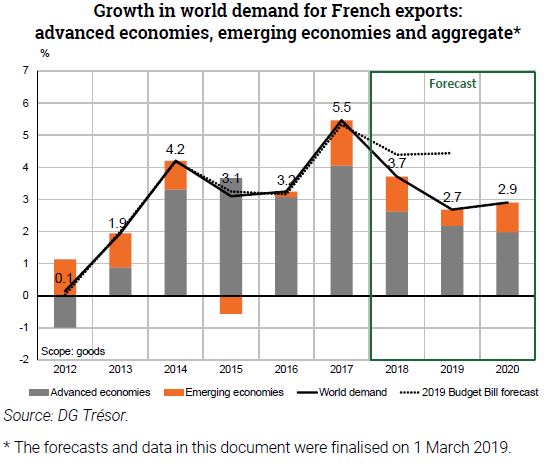

Combined with the build-up of protectionist measures, this weaker economic momentum is likely to put a clear damper on world trade, growth of which is forecast at around 3% p.a. in 2019 and 2020 (after 4.5% in 2018). World demand for French exports is set to follow a similar trend over the forecast period.

This scenario is subject to major uncertainties: the magnitude of the euro area slowdown, the implementation of protectionist measures in the United States, the terms for Brexit, whether China experiences a soft or hard landing, the economic policy stance both in advanced countries (the United States, Spain, Germany and Italy) and in emerging countries (Brazil), and financial uncertainty in the United States and emerging countries.