Trésor-Economics No. 230 - Investigating France's shrinking agricultural and agri-food trade surplus

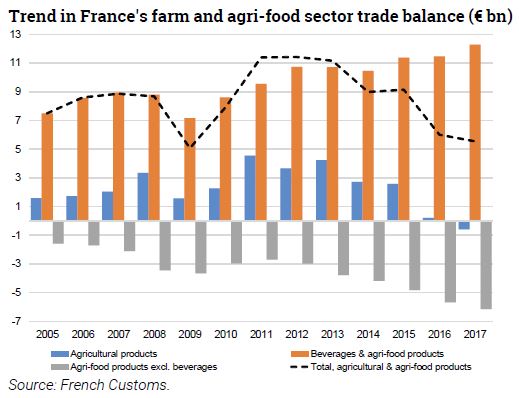

The agricultural and agri-food sector is one of France's strongest export performers. Its trade surplus – €5.5bn in 2017 – is the third largest, on the heels of the aerospace and chemicals sectors. A large proportion of this surplus is attributable to a small number of products, beverages and cereals in particular.

Since the beginning of the 2010s, this surplus has gradually declined. The increased surplus of regional products (notably thanks to higher prices for wines and spirits) has admittedly offset the widening deficit in other processed products, but the trade balance for raw agricultural products (mainly determined by the trend in cereal exports) has deteriorated substantially since 2013.

In line with the general trends in its foreign trade performance, France has seen a sharp decline in its export market shares in the agricultural and agri-food sector over the past 15 years, especially vis-à-vis the European Union, whereas its main European competitors (Germany in particular) have shown greater resilience. It is estimated that a competitiveness shortfall accounts for more than 70% of this decline, with France's relatively weak positioning on buoyant markets contributing to a lesser extent.

This competitiveness shortfall is flagrant in the processed products segment. Since the 2000s, labour costs in the agri-food industry have been higher and have risen more sharply in France than in its main European competitors. Recent measures to reduce labour costs are nonetheless expected to improve the cost competitiveness of the French economy and to feed into the export trend.

Other factors – while not quantified precisely for the time being – may have dampened the agricultural and agri-food sector's competitiveness: the size of farms, high taxes on production, environmental regulations, a lack of value chain integration (upstream and downstream), or a mismatch between French production and international demand.