Trésor-Economics No. 232 - Competition and market concentration in the United States

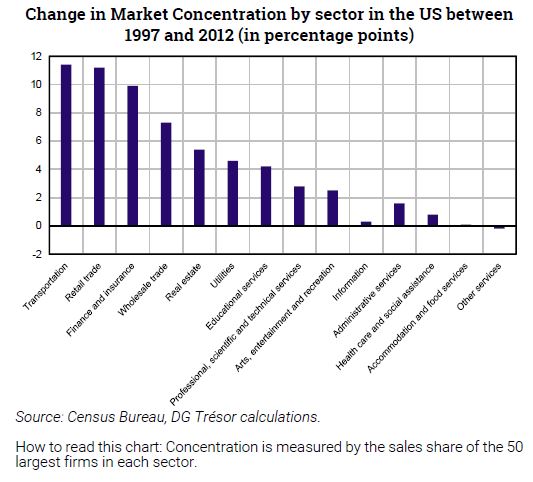

In most sectors, market concentration in the United States has been on the rise for the past two decades. Major companies have a larger market share than before, fuelling a renewed antitrust debate.

This increase may be attributed to several phenomena, but it is difficult to disentangle their respective contributions. Reallocating production to highly productive and profitable companies (the so-called "superstars") has resulted in both productivity gains and increased concentration. The increase in concentration and profits in the US could also be the result of an overall fall-off in the intensity of competition due to weaker competition policies or higher barriers to entry, which may have been facilitated by digital technologies.

Increased concentration may have a negative impact on corporate investment. Its effect on real wages is less certain: on the one hand, an increase in firms' market power may result in higher prices or lower negotiated wages, but on the other, firms that generate profits may also sometimes share some of them with their employees.

These developments contribute to increasing income inequality in the US. Indeed, higher profits mean a transfer of wealth from consumers to capital owners, who are on average better off. Moreover, since productivity and wage gaps between companies contribute significantly to aggregate wage inequality, sharp growth in a small number of highly-productive companies can increase inequality, even in the absence of competition issues.

These phenomena have not yet been clearly identified in Europe, where concentration has remained stable overall. Although certain measurements appear to indicate an increase in profits in Europe, the literature is more divided with respect to this.