Trésor-Economics No. 227 - Global outlook in autumn 2018: growth still robust despite headwinds

After a sharp climb to 3.7% in 2017, the strength of global growth is set to last throughout 2018 and 2019 (3.8%), driven by an acceleration of economic activity in the United States and many emerging countries, in spite of a downturn in the other major advanced countries.

In the United States, the pace of growth is expected to pick up markedly in 2018 on the back of fiscal stimulus, prior to a moderate slowdown in 2019 mainly due to protectionist measures. Conversely, in the United Kingdom, the economy is set to slacken in 2018, levelling off at a more modest rate in 2019 as uncertainties surrounding Brexit weigh on investment and trade. As for Japan, GDP should slump in reaction to the slowdown in exports and a drop in housing investment.

In the euro area, projected growth rates remain solid for 2018 and 2019, despite a downturn in the wake of growing political and trade uncertainties, a less favourable international environment than in 2017 (stronger Euro and higher oil prices), and increased labour market tension. Growth will likely be driven by buoyant global trade and strong domestic demand, underpinned by high levels of corporate and consumer confidence. Germany, Spain and Italy are the three major European countries where it is expected to decline.

In emerging economies, growth in 2019 is set to climb in Brazil and India, remain stable overall in Russia, but fall sharply in Turkey. Chinese growth should gradually slow as measures of monetary and fiscal stimulus taper off.

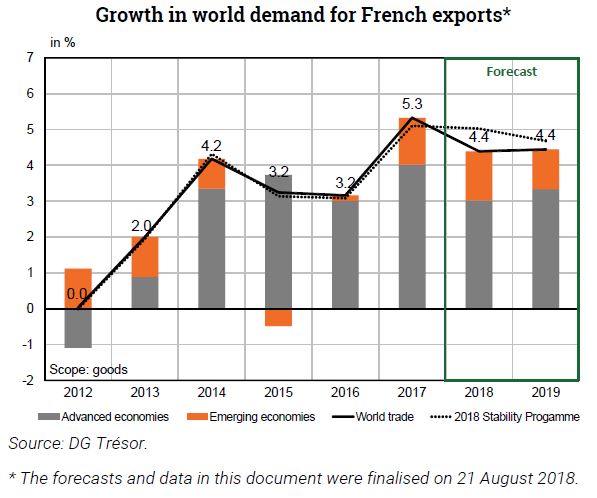

Vibrant global trade is expected to contract marginally (5.5% in 2017, 5.2% in 2018 and 4.6% in 2019), particularly under the combined effects of a slowdown in European imports and gradually weaker Asian imports. Though world demand for French goods is set to remain buoyant in 2018, it should decelerate more than global trade due to its greater exposure to the downturn in European trade.

Uncertainties surrounding this scenario have heightened in recent months, and include: consequences of protectionist measures; Brexit negotiations; the political situation in Italy; Chinese management of fiscal and financial imbalances; risk aversion in reaction to problems in Turkey; the high level of US stock markets.