Trésor-Economics No. 218 - World economic outlook in spring 2018: growth still strong

After a sharp acceleration to 3.7% in 2017, world GDP growth is set to maintain a similar pace in 2018 and 2019 (3.8% p.a.), driven by both advanced and emerging countries.

In the United States, growth is expected to gather pace thanks to expansionary fiscal measures (tax reform and budget agreement in Congress leading to higher public spending). Conversely, growth is likely to slow in Japan (albeit remaining strong thanks to rising exports and higher domestic demand) and in the United Kingdom (due to the negative effects of Brexit uncertainty).

The euro area's recovery is on track to continue at a strong pace. Growth is expected to be driven by dynamic domestic demand against a background of renewed consumer and business confidence, along with robust global demand. Among the major euro area countries, growth is likely to remain dynamic in Spain despite a slight slowdown, stable in Germany thanks to a somewhat expansionary fiscal policy, and also stable in Italy.

In the main emerging economies, growth is expected to strengthen significantly in Brazil, to accelerate to a lesser extent in India, to remain stable overall in Russia and to slow considerably in Turkey. China should experience a gradual slowdown over the forecast period, as monetary and fiscal stimulus measures taper off.

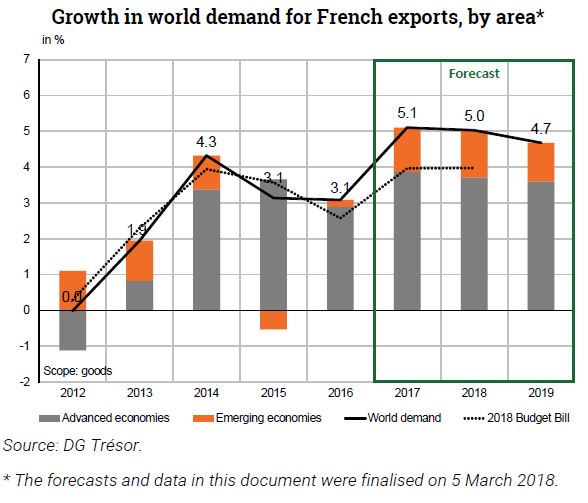

World growth is expected again to get a strong contribution from trade. World trade grew by 5.3% in 2017, a much stronger pace than the more modest growth of around 2.0% p.a. over the previous two years. This trend should remain almost as strong in 2018 and 2019 (world trade growth of 5.1% and 4.7%, respectively). World demand for French exports should display a similar profile over the forecasting horizon.

This scenario is subject to large uncertainties: the implementation of protectionist measures, notably in the United States, which could dampen world trade; political risk in the euro area; the effects of Brexit; the pace of the Fed's interest rate hikes; and financial risks, especially due to the high stock market valuations in the United States and to the elevated debt levels in China.