Trésor-Economics No. 213 - The size of central bank balance sheets: a new monetary policy instrument

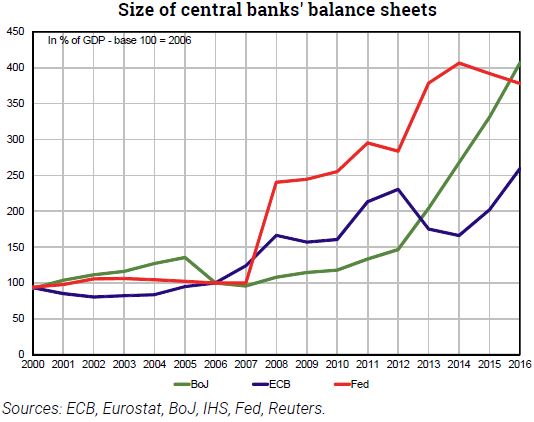

Since the 2008/2009 crisis, the central banks of advanced countries have significantly expanded their balance sheets - not least through asset purchase programmes. With the economic situation improving, the question now turns to possibly reducing balance sheets - beginning in the US - and the economic effects of such a move.

In October 2017, the US Federal Reserve started reducing its balance sheet. In parallel, the Fed continues to raise its key rates gradually. In the euro area, the European Central Bank is still expanding its balance sheet - albeit at a slower pace.

Managing the size of the balance sheet has become a monetary policy instrument in its own right, alongside key interest rates. This development is notably attributable to the zero lower bound. While both instruments can be used to pursue the same objectives (price stability and full employment), they are not perfect substitutes.

Asset purchases have a greater impact on the long end of the yield curve, whereas changes to key rates affect the short end more. Therefore, for the same impact on growth and inflation, these two instruments have different effects on the behaviour of financial and non-financial agents, the profitability of financial institutions, the cost of servicing the public debt, exchange rates and international capital flows.

There is no consensus as to the "optimal" size of a central bank's balance sheet across the economic cycle. However, if a balance sheet is too big, there might be a shortage of eligible marketable assets in circulation, complicating the implementation of further asset purchases. Japan is apparently close to reaching this point.

In the current context, the major central banks will have to strike the right balance between supporting the economic recovery and avoiding financial markets overheating. While the economic recovery is under way, inflation remains low. This situation will probably prompt central banks to rein in their policies very gradually. They will nevertheless be wary of growing risk-taking by financial agents, and in conjunction with prudential authorities, may seek to curtail excesses that could trigger future crises.