Trésor-Economics No. 203 - Sectoral regulations in France

Many business sectors are subject to government intervention in various forms, such as pricing regulations, professional qualification requirements, and State ownership or State control of companies.

These regulations are necessary when free competition does not allow for efficient resource allocation. In these cases, government intervention aims to protect consumers and to ensure the circulation of quality goods and services. Nevertheless, such regulations can be excessive and may favour incumbent firms to the detriment of new entrants. Such regulations result in less competition, higher prices, lower downward pricing pressure on firms, dampened competitiveness, and ultimately lower growth potential for the overall economy.

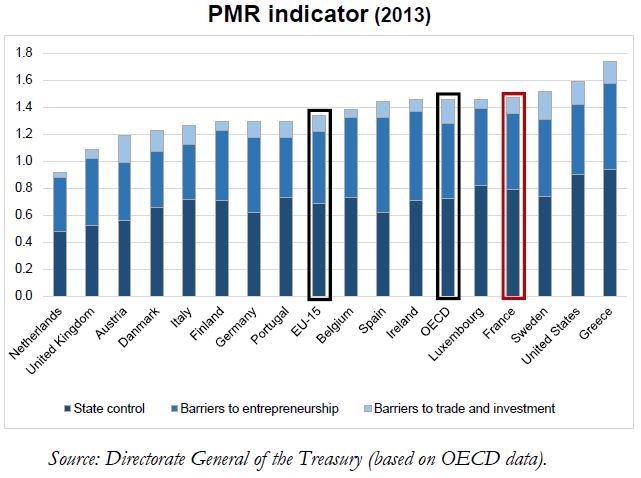

This raises the question of what constitutes the right level of regulation. Every five years, the OECD publishes its PMR (Product Market Regulation) indicators on an economy-wide basis, as well as sectoral indicators. International comparisons of the markets for goods and services are usually based on these indicators. Such indicators facilitate the identification of the French regulation’s specific characteristics and the progress achieved, in terms of deregulation, thanks to reforms. The higher the indicator, the higher the degree of regulation. However, an absence of regulation should not be considered as a baseline.

The OECD's indicators suggest that the French economy is, on average, more regulated than other European countries, while also highlighting the efforts made to reduce regulatory burdens. Thus, the PMR for France stood at 1.47 in 2013, versus an average of 1.34 in the EU-15 (see chart below). This represents a 0.91-point reduction over 15 years. The level of the PMR in France reflects the sizeable stakes owned by the French State in network industries (transport, communications and energy).

Several recent measures, implemented since the PMR was most recently published in 2013, have been designed to significantly enhance France's position. These measures include the “simplification shock” (a radical administrative streamlining and regulatory reform) started in March 2013, along with the Growth, Economic Activity and Equal Economic Opportunity Act of August 2015 (also known as the Macron Law). Consequently, at the time of its next publication, the PMR indicator should decline from 1.47 to 1.34 for France, thus reaching the average for the EU-15 at the time of the last publication.

However, these indicators present certain limitations. They focus on the existence of regulations, without always taking into account the legitimacy or proportionality of such regulations. In addition, these indicators are not always suitable for each country. Although they provide a snapshot of the regulations and sectors that offer the potential for reform, only a detailed analysis of the competitive structure of each sector can identify the actual need for refor.