Trésor-Economics No. 208 - Why is global inflation still so low?

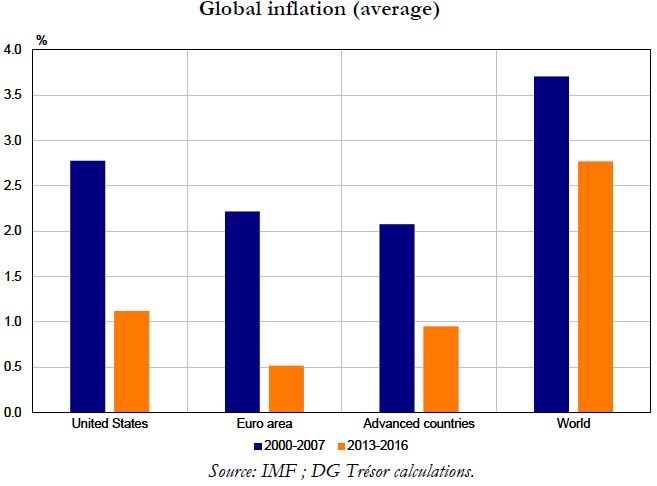

Global inflation has declined sharply since 2012 to levels generally below central banks' inflation targets. The uptick over the past year is mainly attributable to a recovery in oil prices, and could be curtailed if higher prices do not feed through significantly to wages. So far, core inflation (excluding food and energy) has remained virtually flat.

A long period of low inflation has numerous related costs. A reduction in inflation increases the real cost of past debt and compels economic agents to use a larger portion of their income to pay down debt. This, in turn, involves weaker investment and consumption. Furthermore, in a context of nominal rigidity, low inflation makes it difficult to adjust real wages downwards during an economic shock, thus amplifying the adverse impact on employment. Finally, a lasting period of low inflation leaves central banks little room of manoeuvre when key interest rates are already at low levels – as is the case today.

Low global inflation is caused by several factors: (i) a continued imbalance between supply and demand, due to weak economic momentum in the aftermath of the crisis, overinvestment in some sectors in China, and the ageing of the world population; (ii) weak wage momentum, especially in advanced countries (reflecting a reduction in workers' bargaining power, globalisation, wage moderation policies in some countries, or untapped labour reserves not fully reflected in unemployment statistics); (iii) lower inflation expectations following a period of low inflation; and (iv) the decline in oil prices since 2014. At the same time, the banking sector's difficulties and the need for the private sector and government to deleverage in some countries have dampened demand and made monetary policy less effectiv.

In the medium term, core inflation is set to recover only very gradually, driven to a certain degree by an upturn in demand (private sector credit growth, lower unemployment rate, recovery in wages, etc.), even though inflation has become less responsive to the economic cycle than previously. However, the aforementioned structural factors are expected to continue to have a dampening effect.

The current context of low core inflation calls for: (i) continued monetary support, especially in the euro area and Japan, where core inflation remains very low; (ii) the roll-out of pro-wage growth policies in countries with sizeable current account surpluses, notably in the euro area; and lastly (iii) a change to the industrial policies driving global sector overcapacity, notably in China.