Trésor-Economics No. 201 - Will the recovery in French residential investment last?

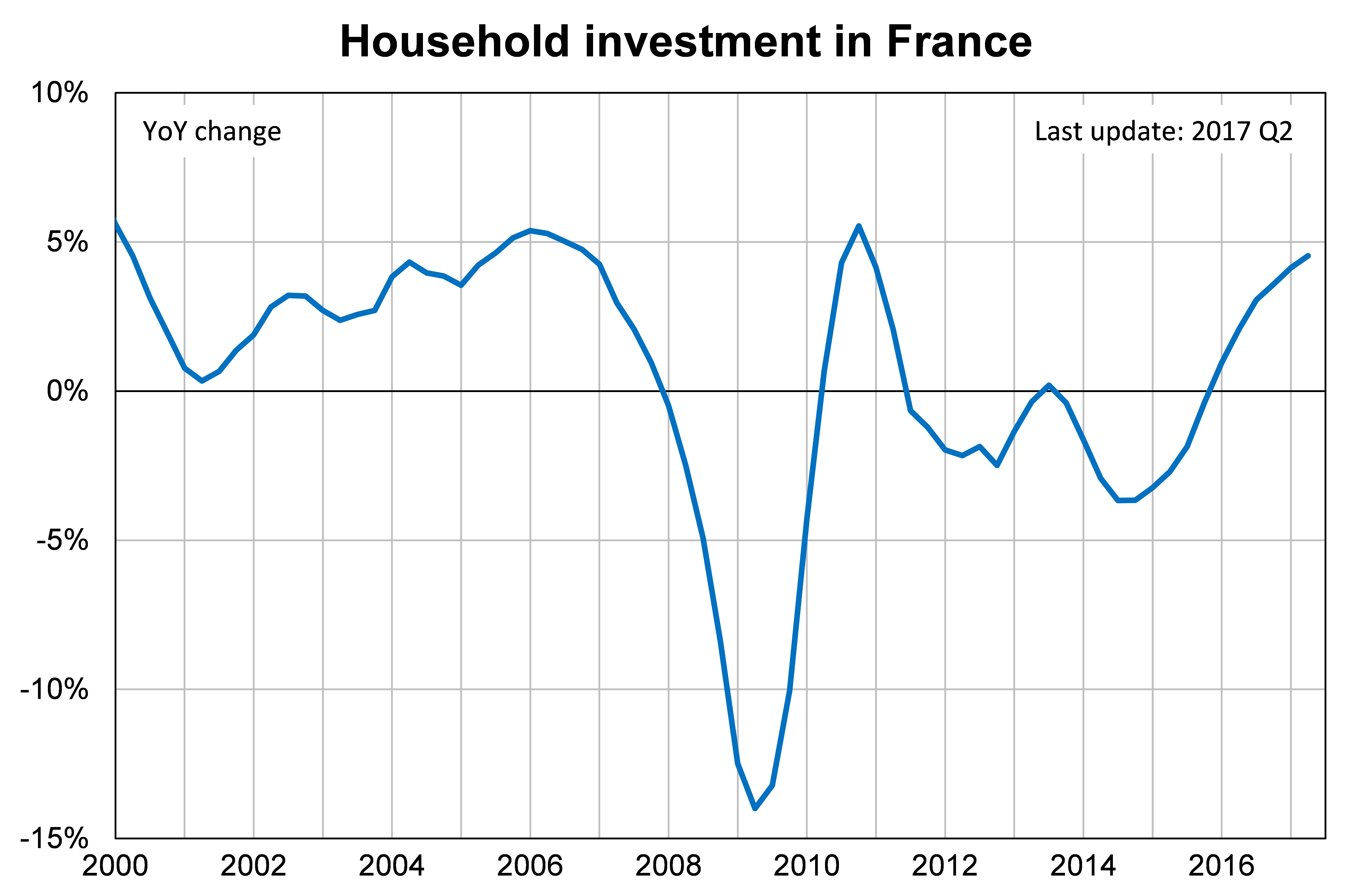

Residential investment by French households grew strongly from 2000 to 2007, before dropping sharply during the 2008-2009 crisis. After a brief rebound in 2010-2011, it returned to a downward trend. By 2015, it had fallen back to its early 2000s level. This negative performance explains a large share of the GDP growth gap between France and Germany from 2008 to 2015.

The 2000-2007 expansion mainly reflected the rise in household income. Rising housing prices also fuelled home purchases, with home-buyers expecting capital gains. The steep fall in investment during the crisis was accompanied by a decline in housing prices amid high economic uncertainty and substantial job losses. The 2010-2011 rebound was linked to the improvement in these fundamentals and the support provided by the significant fall in interest rates, which eased the access to credit. The 2012-2015 decline was partly due to lower household income growth, while declining housing prices may have helped to keep potential investors on the sidelines.

The regulatory framework and public policies to stimulate home-buying also influence investment decisions. In the short term, for example, measures to support housing demand trigger expectation effects.

Household investment has regained momentum in France since mid-2015. The upturn is expected to continue in 2017 and 2018, given the positive trend in building permits and housing starts, rising housing prices and the improving macroeconomic environment.