Trésor-Economics No. 205 - The global economic outlook in September 2017: signals remain upbeat

After a two year slowdown, global economic activity is set to gather pace in 2017, with 3.6 % growth, driven by both advanced and emerging economies, before continuing at the same pace in 2018.

In the US, growth is likely to be stronger in 2017, thanks to a rebound in private investment, then again in 2018, assuming a fiscal stimulus package is implemented. In Japan, economic activity is expected to accelerate sharply in 2017, boosted by a recovery in private demand, before slowing in 2018. In the UK, growth is set to decrease due to the initial negative effects of the Brexit vote.

Euro area recovery should continue at a strong pace. Private investment is set to remain dynamic, benefiting from continued ECB monetary support and improved financing conditions, and the acceleration in global demand is likely to drive exports despite the euro's recent strengthening. In the largest euro area economies, growth is expected to gather pace in Germany and Italy, and to remain dynamic (albeit not as high) in Spain.

Economic prospects in emerging economies are uneven. Russia and Brazil are gradually recovering from recession, and India continues to experience very dynamic growth. In contrast, Chinese economic activity is set to slow significantly in 2018, and the recovery in Turkey since late 2016 is expected to run out of steam.

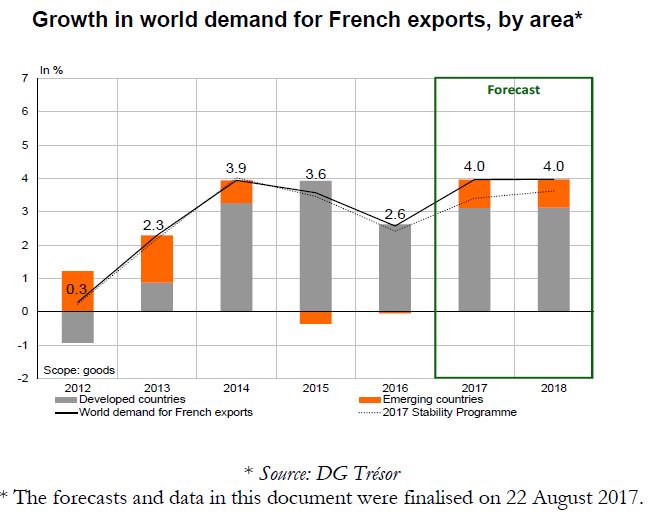

World growth has seen a renewed stronger contribution from trade since end 2016. World trade is clearly accelerating in 2017 and is expected to grow by 4%, followed by steady growth in 2018. World demand for French exports should display a similar profile over the forecasting horizon.

This scenario is subject to several risks: political developments in the US; the terms and effects of Brexit; the magnitude of the slowdown expected in China; financial risks, notably with regard to the current highs on US stock markets. Lastly, world trade growth could be stronger than anticipated if the dynamic trend observed since late 2016 continues.