Trésor-Economics No. 200 - Clarifying the contributory component of social protection

In France, much of the high level of government expenditure (57.3% of GDP in 2014) can be explained by the size of government social protection systems. The benefits paid by these schemes account for half of government expenditure (€630bn in 2014, or 29.4% of GDP). Most of this expenditure takes the form of retirement pensions and healthcare insurance payments.

Most of these schemes are contributory (57% of the amounts paid, or 16.7 percentage points of GDP). This means that benefit amounts depend on the contributions previously paid by the recipient. The main contributory plans are the retirement pension schemes and the unemployment insurance, whereas healthcare insurance and family benefits are mainlygranted to every citizen regardless of their contributions.

A high level of government expenditure automatically leads to a high level of taxes and social security levies, but there is reason to think that the levies allocated to financing contributory schemes could be less adverse for growth and jobs. Contributory schemes use contributions to finance benefits that are ascribed directly to the contributor. Therefore, they could be seen as deferred income or mandatory insurance rather than as taxes. In contrast, levies that finance non-contributory plans (healthcare insurance and family benefits) are no different from taxes on wages, economically speaking.

Unfortunately, the complexity of payslips and the lack of transparency about financing for social protection mean that it is difficult today for wage earners to make the distinction between the contributory and non-contributory social levies deducted from their paycheques.

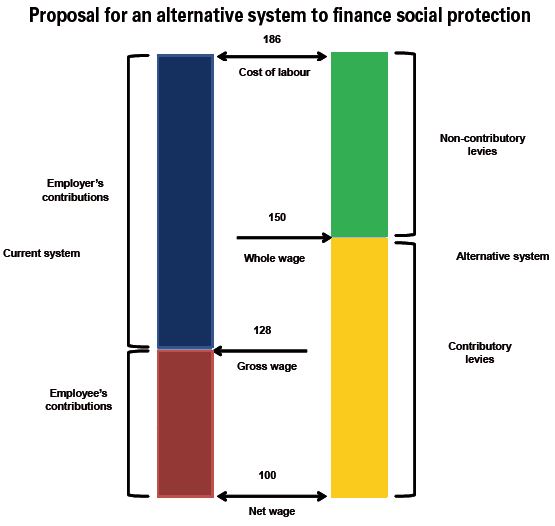

Consequently, a reform of payslips would have the dual advantage of clarifying the roles of the different plans paying benefits, as well as providing better economic incentives, which could help to boost the labour supply. Such a reform could also replace the usual legal distinction between employers' and employee's contributions on payslips with a more economically-based distinction between contributory and non-contributory levies and would clarify which social levies are used to finance contributory benefits.

This would ultimately promote a change in wage bargaining, which would no longer focus on gross wages (including employees' contributions and excluding employers' contributions, or some 130% of net wages). Instead talks would focus on the "whole wage" (net wage plus contributory levies, or some 150% of the net wage), which is more representative of the wage earner's true compensation.