Trésor-Economics No. 198 - An examination of inflation forecasts in budget bills

Between 2013 and 2016, inflation, within the meaning of the consumer price index (CPI), was almost one percentage point lower than budget bill (PLF) projections. This can either be put down to an increased difficulty in forecasting inflation in an extraordinary economic environment (very low inflation, European Central Bank key interest rates constrained by the zero lower bound, rollout of new instruments) or to other more usual reasons such as unforeseen exchange rate and energy price fluctuations.

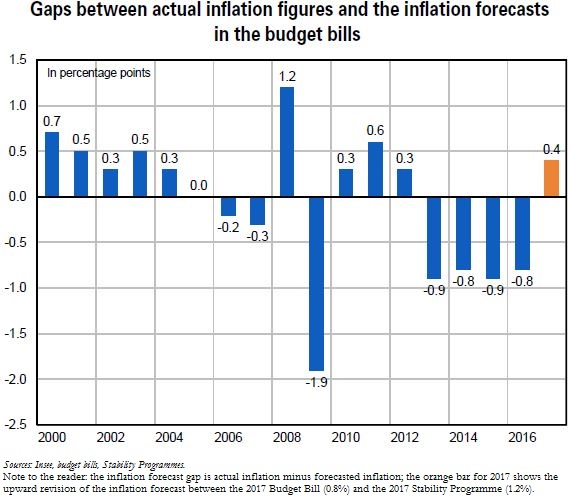

Since 2000, budget bill inflation forecasts have been unbiased: on average, there were no differences between forecasts and actual figures although, for some years, these were significant (refer to the chart below). For the same period, deviations from budget bill projections were always approximately the same as those of other forecasting bodies such as the International Monetary Fund, the European Commission and Consensus Economics, with an average absolute deviation of 0.6 pt.

The majority of the forecast gap is due to unforeseen variations in energy prices. Oil price and exchange rate fluctuations, that occurred after the freeze applied in a standard manner when the budget bill forecast was made, accounted for over a half of the total inflation forecast gap for the period 2007-2016 in absolute terms.

The aforesaid fluctuations have an impact on both energy inflation and core inflation. As a result, a depreciation of the euro increases businesses' intermediate consumption prices. Similarly, a rising oil price causes an increase in businesses' input prices as well as, over time, a rise in wage demands as employees look to protect their purchasing power faced with higher pump prices. In both cases, companies will offset a proportion of their increased costs against sale prices.

The rollout of disinflationary economic policies (Competitiveness and Employment Tax Credit and the Responsibility and Solidarity Pact) and the larger-than-expected effect on prices of growing competition in a number of sectors (mobile telephones, mass retail) also account for part of the forecast gap on core inflation noted since 2013.

For 2017, the Stability Programme of April 2017 revised inflation upward from the 2017 Budget Bill figure of 0.8% to 1.2%. This is mainly a reflection of the upswing in oil prices between autumn 2016 and spring 2017.