Trésor-Economics No. 196 - A contribution to the work on deepening the Banking Union

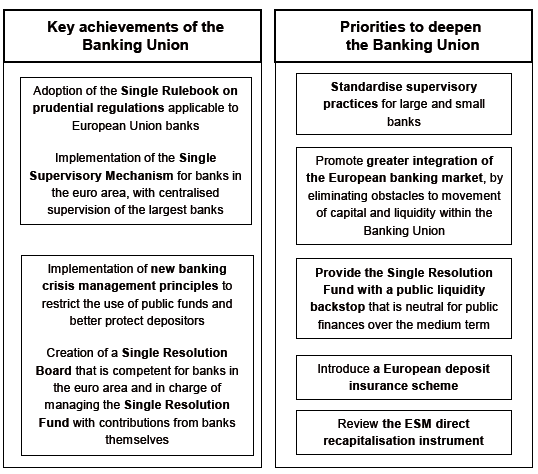

Creation of Banking Union was spearheaded by the European Council, which opted for this approach on principle in 2012, in response to the financial and sovereign debt crisis, while also bolstering prudential requirements for banks at the same time. Its establishment reflects an in-depth change to the supervision and structure of the European banking system, aiming at better financing the euro area economy and promoting financial stability. The Banking Union comprises new European authorities to ensure single supervision and shared Europe-wide resources to handle banking crisis at central-level. It marks a major step in further deepening European integration and in ensuring the proper functioning of the Economic and Monetary Union (EMU), by making the banking system more resilient to asymmetric shocks.

The foundations of the Banking Union were laid in a short space of time and the full impact in terms of the operation of regulation and supervision has not yet been totally grasped. Crisis management resources are not yet fully shared and European banking systems still carry a hefty domestic bias, partly due to the persistence of difficulties that emerged before the implementation of the Banking Union and that have not yet been resolved. Moreover, the Banking Union does not yet offer full protection against contagion between banking risks and sovereign risks and is therefore incomplete.

Full completion of the Banking Union is a key priority to consolidate the European supervisory framework and fully derive the expected benefits for integration of the internal banking services market. It must further improve financial stability via more robust, intrusive and standardised banking supervision, and by limiting domestic bias. It must continue reducing the risks of contagion between banking and sovereign risks and further safeguard European taxpayers' money, primarily by providing the banking crisis resolution fund (Single Resolution Fund made of shared banking contributions) with the support of a public liquidity backstop which would be neutral for public finances over the medium term, and also by providing the Union with a European deposit insurance scheme. This will promote a more unified European banking system and foster bank restructuring. Thus more solid and efficient banks will finance the euro area economy. Lastly, the institutional framework of the Banking Union could be simplified in order to reduce the risk of responsibilities being excessively divided out among the various European authorities.

The transition period until full implementation of these mutualized mechanisms (2024 at the latest) should be used to deal with the enduring effects of the crisis on some banking systems and round out the Banking Union by creating new crisis prevention and management systems, working in a balanced and parallel way towards fresh measures to share and reduce banking risks.