Trésor-Economics No. 195 - Impact of foreign exchange policies for commodity-exporting countries

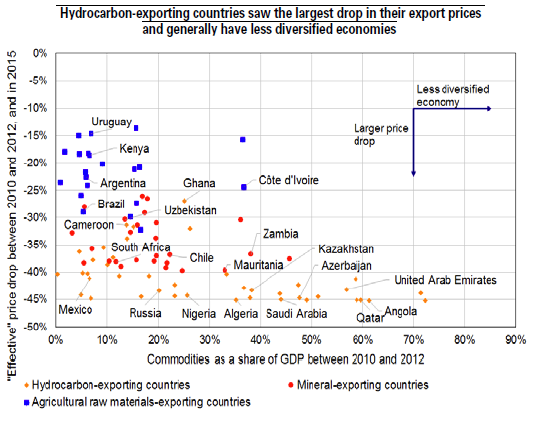

Commodity prices plummeted between 2014 and 2016. Oil prices fell by half, mineral prices were down by approximately one-third and agricultural raw materials prices tumbled by 20%. Despite the recent upturn in prices, low prices have done considerable damage to exporting countries' current account balances, especially countries without diversified economies.

Commodity-exporting countries adjusted in different ways, depending on the severity of the shock, their leeway for changing economic policies and their foreign exchange regime (fixed or floating exchange rates). Some countries ended up loosening their foreign exchange regime, as in the case of Russia and Egypt.

Economic theory, along with the experience of recent years, suggests that the most appropriate foreign exchange regime depends on the individual characteristics of each economy. For countries with fairly diversified economies, a floating exchange rate is generally an advantage, since a dip in the exchange rate improves the competitiveness of their non-commodity exports and provides a boost for their medium-term current account balances and growth.

In contrast, for commodity-exporting countries that do not have diversified economies or countries that have only a single export (mainly countries in the Middle East or Africa), a dip in the exchange rate does not usually boost export volumes, since their commodity exports are priced in foreign currencies on international markets. In this case, a lower exchange rate contributes to improving the current account balance merely by raising the price of imports. This reduces import volumes, leading to inflation and lower growth.

This means that a fixed exchange rate could be better for an exporting country without a diversified economy or a country with a single export, as long as the central bank has enough credibility to maintain the currency peg. However, if low commodity prices persist, an adjustment eventually becomes inevitable. In the medium term, this is often achieved through fiscal consolidation, which is an important means of improving the current account balance. In the longer term, economic diversification mitigates the country's vulnerability to shocks. This often requires efforts to avoid setting an excessively high exchange rate.

Some countries lack the necessary foreign exchange reserves to maintain their currency peg when commodity prices are low. In such cases, central bank intervention on foreign exchange markets to defend an unsustainable peg may be counterproductive. Even though switching to a floating exchange rate may trigger abrupt adjustment, this step should be taken before foreign exchange reserves are depleted. In this manner, the remaining reserves can be used to manage volatility and preserve financial stability, particularly when economic agents' debts are denominated in foreign currencies.