Trésor-Economics No. 192 - The G20's accomplishments, 10 years after the crisis

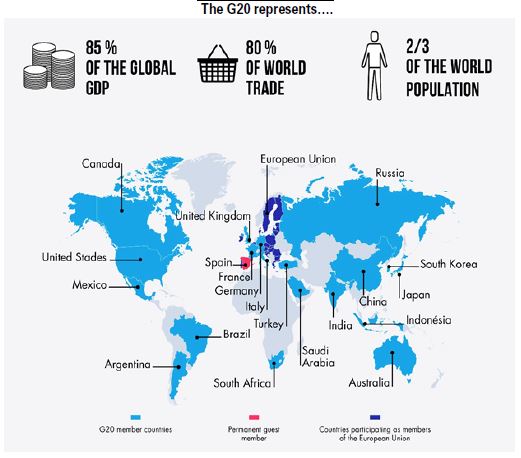

The Group of Twenty (G20) was created to deal with international economic and financial challenges that require coordination that extends beyond the group of developed countries. After the 2007-2009 crisis, the G20 became the leading forum for multilateral economic and financial cooperation. The G20 initiated coordinated fiscal and monetary stimulus plans on a very large scale. It also decided to increase the IMF's resources vastly, along with the resources of the leading development banks. The G20 helped put the world economy back on the path to growth and provided impetus to several far-reaching financial reforms.

The G20 has striven to enhance confidence in the financial system by undertaking thoroughgoing work on re-regulating the financial sector. The G20 set up the Financial Stability Board and entrusted it with a key role. The FSB's predecessor, the Financial Stability Forum, had much more limited functions and prerogatives. The G20 gave critical impetus to work on the Basel III Accord, which now requires increases in level and quality of banks' capital and better monitoring of their liquidity. A total loss-absorbing capacity was introduced to provide a better response to the problem of institutions deemed to be "too big to fail". The regulation of derivatives and of the shadow banking system was also strengthened.

The G20 has progressively moved from being a crisis management body to becoming an informal steering committee for the world economy, providing the political impetus for setting standards and sharing best practices in an increasingly varied range of economic and financial areas. Its main objective is to establish consistent and fair ground rules for international economic activities that ensure a level playing field. The G20 spurred the OECD's work to promote the exchange of tax information and maintained strong pressure on tax havens and non-cooperative jurisdictions. In 2012, the G20 also provided the impetus for the OECD BEPSplan, which was finalised in 2015, signalling an unprecedented boost for the work against aggressive tax planning by major corporate groups. A stronger role for the FATF and a tightening of its international standards also boosted the fight against money laundering and terrorist financing. Finally, the G20 has addressed other international issues, including trade, the climate and development. The G20 has notably built on the lessons learned from the failure of the Doha Development Round to preserve multilateralism on trade under the aegis of the WTO. For the first time, collective principles on international investments were adopted in 2016. The G20 has also supported the political drive that led to the Paris Agreement on Climate Change in 2015, and the 2030 Agenda for Sustainable Development.

Even though the world still faces many challenges, the dynamic created by the G20 has helped to make the world economy more resilient and enhanced our capacity to respond to burning issues. Several events illustrated this resilience and capacity in 2016, such as Brexit, the American elections, terrorism and the leaking of the Panama Papers. The G20's ability to cope with growing uncertainty surrounding the global economy and the future of multilateralism will be put to a decisive test.