Trésor-Economics No. 190 - A contribution to the work on the strengthening of the euro area

The euro is an economic and political project like no other. Today, 340 million people across 19 Member States use on a daily basis a stable and credible currency. The euro is the second most commonly held reserve currency, accounting for one-quarter of all holdings worldwide. The economic and financial crisis triggered a raft of reforms that sought to make the Economic and Monetary Union (EMU) more resilient: tougher economic and fiscal governance rules, the Banking Union, and new mechanisms to manage sovereign debt crises.

Yet the euro area remains a work in progress, with some way to go on financial and fiscal integration, dealing with macroeconomic imbalances within the zone, and strengthening cohesion. Gaps in financial integration are weighing on efficient capital allocation. Euro area fiscal policy – intended to deliver macroeconomic stability and public finance sustainability – is not fully up to the task. Eventually, current unit labour cost trends mean that imbalances within the union are unlikely to be absorbed in the short term.

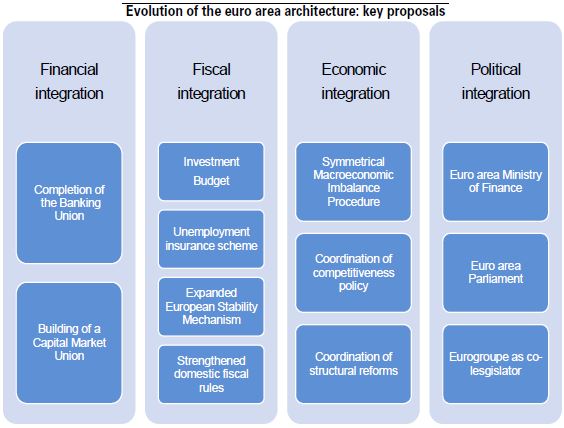

The euro area architecture therefore needs to be strengthened, in three areas in particular. Firstly, the EU needs to complete the Banking Union and press ahead with the Capital Markets Union. This, in turn, would boost financial sector integration and see improved private sector risk-sharing. Secondly, the euro area needs its own sizeable budget and domestic fiscal rules need to be tightened. Together, these measures would increase macroeconomic stability, pave the way for convergence, and shore up public finance sustainability. Thirdly, a more coordinated approach to structural reform would help to reduce current account imbalances and boost economic integration within the euro area.

Such proposals would imply much closer integration and further sovereignty-sharing on fiscal and economic policy. Consequently, the euro area institutional framework needs to be overhauled to provide for a more democratic functioning of the euro area. Yet this would require treaty change – a matter on which Member States do not currently see eye to eye. In the short term, the EU must continue to demonstrate its ability to ensure the cohesion of its members in the context of the withdrawal of the United Kingdom and to address concretely the main concerns of its citizens, in particular within the relaunch of the European project agenda agreed upon at the Bratislava summit of September 2016.