Trésor-Economics No. 189 - Composition and allocation of the distributable surplus in France since the crisis

The analysis of the distributable surplus examines how the benefits of growth are shared. The distributable surplus is the share of GDP growth available for improving the real remuneration of the factors of production. It is therefore the share of growth not used to remunerate the increase in the volume of factors of production. The surplus is composed of productivity gains and the change in the amount appropriated by the rest of the world through variations in the terms of trade.

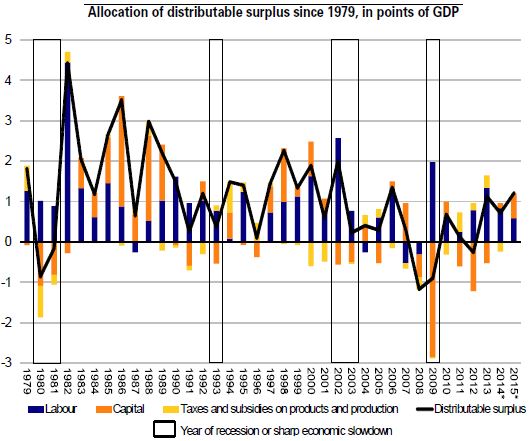

The distributable surplus is allocated between (i) employees and the self-employed through changes in hourly compensation and (ii) holders of capital via changes in the return on capital.

Over the long run, France's average distributable surplus has fallen sharply, mainly owing to slower productivity growth. In annual average terms, the distributable surplus fell from nearly two points of GDP in the 1980s to less than one point of GDP from the early 1990s on, with a further decrease since the 2008-2009 financial crisis.

The distributable surplus varies from year to year depending on economic factors-above all, energy prices but also the productivity cycle. In France, such shocks are mainly absorbed by the short-to-medium-term return on capital. This phenomenon was particularly significant in the 2008-2009 recession, and up to 2013.