Trésor-Economics No. 185 - The financial sector facing the transition to a low-carbon climate-resilient economy

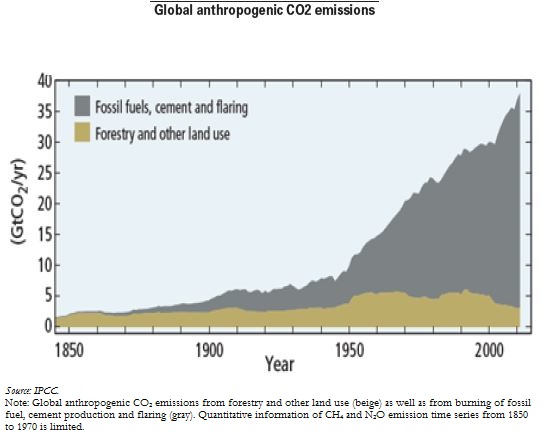

The significant economic growth and the profound structural changes that occurred since the end of the 19th century have proceeded hand-in-hand with an unprecedented rise in temperatures as well as broader changes to global climate. At COP21 in Paris, the common realization that continuous global warming could lead to irreversible damage to the planet led the international community to confirm and enhance the long-term objective on combating climate change established in 2010: to hold the increase in global average temperature to well below 2°C, and to pursue efforts to limit the temperature increase to 1.5°C.

Reaching this goal represents a significant economic challenge, requiring adequate climate policies (cap and trade, carbon tax). The financial sector has a particular role, as it will finance the energy transition. A redirection of investments coupled with some additional capital will indeed be necessary to successfully transform our economies. In that respect, creating the appropriate conditions for transition-favorable investments to take place is essential.

A climate-consistent capital allocation matters for the adequate management of the risks (and opportunities) climate change represents for the financial sector. Information on the financial implications of climate change as well as a business-oriented appropriation of climate issues by the financial sector are key factors for risk management.

Recent policy initiatives have been launched with this perspective by several jurisdictions as well as international organizations. France has been at the forefront by introducing over the years a consistent policy package that promotes a better integration of sustainability throughout the economy, including the financial sector. A milestone of these efforts has been the adoption of the Energy Transition for Green Growth Act, which defines a long term strategy including a carbon path and encourage the financial sector to get to grips with this topic through its article 173.