Trésor-Economics No. 184 - Japan's response to deflation: an assessment of Abenomics

Japan’s fall into deflation is explained by two sets of factors. The first were structural, such as the fading of the positive effects of technological catch-up and population ageing. The second were more cyclical like the economic downturns following the burst of the real-estate and stock-market bubble and the end-1997 economic crisis of the Asian countries. Since then, Japan has never experienced a lasting spell of positive inflation.

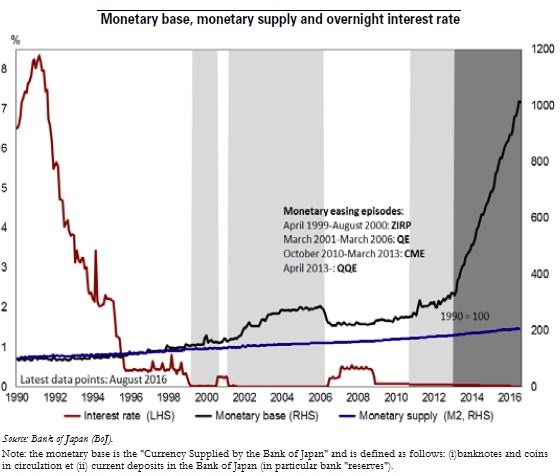

The economy did not recover completely in the 2000s, presumably owing to an inappropriate policy mix and the absence of far-reaching structural reforms. The policy known as Abenomics, launched in December 2012, seeks to remedy these weaknesses in order to achieve a permanent exit from deflation and revitalize growth through short-term fiscal and monetary support coupled with structural reforms and a medium-term fiscal consolidation plan.

However, four years after its launch, Abenomics has yielded mixed results. The initial encouraging effects of the confidence shock observed in 2013 and the yen's depreciation have evaporated. Monetary policy has promoted the exit from deflation, but credit growth remains slack and the massive effects on financial portfolio reallocation are slow in coming. Beyond the short-term stimulus, the persistence of an accommodative fiscal policy is incompatible with consolidation objectives, and some structural reforms have been delayed or are still in the planning stage.

The key short-term issue is how wages will respond to prices. Initially, the nature of the jobs being created curbed the impact on wage movements of rising tensions in the labour market. However, the sectoral shortages that have developed in recent years and are starting to exert and upward pressure on wages. This trend should continue in order to trigger a price-wage spiral capable of ensuring a permanent exit from deflation.

In the longer run, the major challenge for Abenomics is to successfully implement the productivity and labour-force reforms that are fundamental for correcting the Japan’s structural headwinds. The expected effects of these long-term reforms and the further efforts to achieve fiscal consolidation in the medium term would also mitigate the effects of higher interest rates. However, the concerns over the sustainability of the public debt are at this stage moderate as most of the debt is held by residents.

Finally, Japan's difficulty in achieving a sustained exit from deflation is inciting the developed economies to draw lessons from this experience in order to better calibrate economic policy responses to sluggish prices and GDP growth. Preventing the risk of entering deflation thus seems a useful approach to avoid a "disanchoring" of expectations. Furthermore, the potential deflationary effect of Japans’s population ageing encourages to implement reforms to offset the decline in the labour force and limit its effect.