Trésor-Economics No. 182 - The debate on secular stagnation: a status report

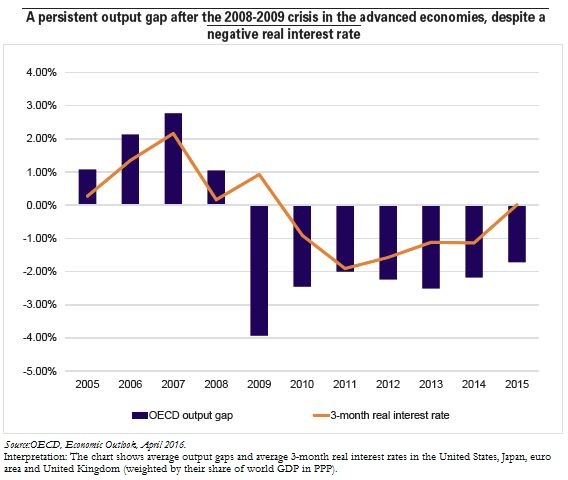

The concept of secular stagnation was introduced in 1938 by Alvin Hansen, who was concerned that investment might be too low to achieve full employment. After being forgotten for decades, the concept was revived in November 2013 by Larry Summers, who defined it as a situation in which the economy is unable to approach its potential growth rate, for reasons that include the difficulty of sufficiently reducing real interest rates.

The concept initially focused on persistent slackness of demand, but now also encompasses a weakening of potential growth, and particularly of productivity and capital accumulation. The explanations for economic weakness based on supply and demand factors are not exclusive; indeed, they mutually strenghten one another. Slack demand can curtail potential growth through hysteresis effects such as the loss of human capital due to the persistence of long-term unemployment. Reciprocally, expectations of weak long-term potential supply can restrain demand even in the short term.

The geographic scope of application of the secular stagnation concept is still open to question. While some economists stress the importance of the global dimension, the initial applications have often been proposed at national level. At present, the academic debate centers on the international transmission of secular stagnation and the attendant risks of currency wars and global economic stagnation.

The concept of secular stagnation is the subject of lively debate among economists, in regard to its reality and its causes. Most economists, however, agree on the need for a global response to avert the risk of lasting stagnation– a response combining monetary, fiscal and structural measures, that are preferably coordinated at international level.