Trésor-Economics No. 181 - The world economy in summer 2016: moderate but gradually accelerating growth

World growth in 2016 is showing fresh of weakness, having contracted in 2015 on a slowdown in emerging economies. Global activity has been affected by a soft patch in the United States in the first half year. The pace is expected to quicken in 2017 as the US economy gathers momentum and Brazil and Russia gradually pull out of recession.

The uncertainty generated by the UK referendum on remaining in the European Union (EU) is expected to lop nearly one percentage point off overall growth for 2016 and 2017. Most of the impact during that period is likely to come from faltering business and consumer confidence, worsening financial conditions and a possible surge in market volatility. The slowdown will have a limited impact on growth in the euro area. Having strengthened further in early 2016, the UK economy will stop growing in 2017 due to the gradual disappearance of positive externalities – notably oil price softness and euro depreciation – and to the effects of Brexit.

US activity is expected to pick up in 2017 once the current year's lull has subsided. This soft patch is due to an earlier run-up in the dollar and to oil industry troubles caused by falling prices. Japan is also likely to see a surge in activity in 2017 thanks to a huge stimulus package. In emerging economies, overall growth is expected to be slightly brisker than in 2016 despite an ongoing slowdown in China and a likely halt to economic growth in Turkey. These developments are mainly due to a bottoming out of the recession in Russia and Brazil.

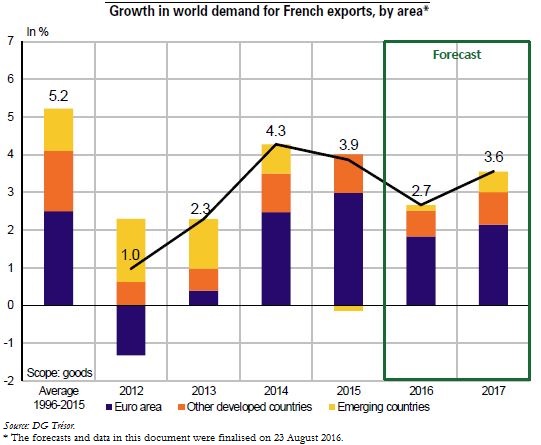

World trade should continue to slow in 2016 on disappointing first-half imports into the euro area and China and weakening domestic demand in the United States and the United Kingdom. A gradual acceleration is expected in 2017, driven mainly by stronger activity. World demand for French exports should follow a similar pattern, while continuing to outpace growth in world trade, since France's exports depend less than world trade does on emerging economies.

The extent of the fallout from the UK referendum is still unclear. The country's growth will be responsive to progress on EU exit negotiations, and its policy mix could be adjusted to underpin the expansion. Fiscal policy settings are another major contingency, especially in Japan, where the timing and extent of the stimulus package are uncertain. Political and financial tensions prevail in emerging economies, and China's efforts to rebalance its economy are still prone to significant risks. By contrast, in light of recent encouraging signals, the likely recoveries in Brazil and Russia in 2017 could be stronger than expected. The risks to this global economic scenario seem to be in balance.