Trésor-Economics No. 172 - Is there too little private investment in Germany?

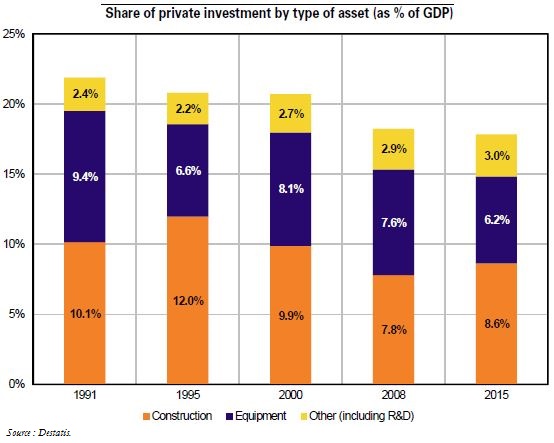

Private investment as a share of the German economy has fallen since the mid-1990s. It stood at 21% of GDP at the time, and has stagnated below 18% of GDP since the 2008 crisis. After the post-reunification boom, construction slowed in the 2000s, and the investment downturn then spread to the rest of the economy.

Since the crisis, German private investment has shifted away from equipment and towards construction. Equipment investment has proved more sluggish than expected when gauged against its usual determinants, for economic activity has been relatively strong, financial conditions favourable, and capacity utilisation high. Firms seem particularly sensitive to the high level of uncertainty, which could influence their investment behaviour.

Business investment decisions may also be impeded by several specific features of the German economy:

- Ageing of the owners of Mittelstand companies , who tend to invest less as they grow older. Half are over 50 years old, and the situation is compounded by the lack of prospects for selling or handing over their firms as they approach retirement.

- Internationalisation of German firms. In seeking to optimise global value chains, German firms may have improved their export competitiveness, while balancing domestic investment against outward foreign direct investment (FDI).

- Hiring difficulties. For many years, companies have reported problems in filling skilled positions, particularly for manual occupations. This may have become a major obstacle to investment.

Low equipment investment reduces capital accumulation, which could restrict medium-term economic growth, all the more as population prospects could lead companies to continue the downward adjustment in their capital stock. These negative prospects could be offset in part by investment quality, particularly the rise in research and development (R&D) investment. R&D investment has registered over 20 years of virtually uninterrupted growth, and could boost Germany's potential growth by raising total factor productivity.