Trésor-Economics No. 168 - Impact of the oil price decline on France and the global economy

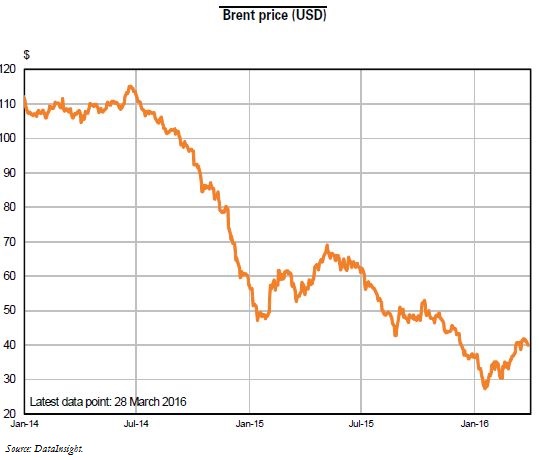

After remaining consistently above USD 100 per barrel from 2011 through mid-2014, oil prices have plummeted by more than 70% since the summer of 2014. The decline was initially attributed to a combination of weaker than expected global demand for crude oil and an abundant market supply. Since mid-2015 however, world oil demand has been essentially in line with expectations, and the drop appears more a reflection of the sustained high production quotas applied by the Organization of Petroleum Exporting Countries (OPEC) coupled with North America's strong production of unconventional oil and gas. The International Energy Agency (IEA) believes that oil supply could remain abundant in 2016 because it is taking some time for the price decline to translate to any significant drop in the production of unconventional oil and gas (produced directly from source rock, mainly shale oil) in the United States, and because Iran could boost its production by 20% over the year.

In the past, lower oil prices have had highly positive consequences for the global economy. The favourable impact on growth has been the result of two factors: the lower cost of an input for firms outside the oil and gas sector and, on the demand side, the redistribution that takes place on a global scale between producing countries and importing countries (commodity exporting countries have historically saved more out of their revenue than other countries).

The impact of the current oil price decline on the global economy should continue to be positive, but several potentially cumulative factors could limit the benefits: (i) positive effects on importing countries could take longer to become apparent, (ii) weak oil prices have placed a number of exporting countries in an extremely difficult situation, leading them to implement restrictive economic policies, (iii) the curbing of purchases and/or sales of financial assets by sovereign oil funds. Furthermore, the oil price decrease could lower inflation expectations and thereby complicate the task of monetary policymaking. In addition, the U.S. economy is affected by its increased exposure to the energy sector.

In any case, the current oil price slump is undeniably supporting growth in the euro area, particularly in France. In France, lower prices at the pump appear to be having the direct effect of increasing household purchasing power in the short term. Businesses appear to have the benefit of lower production costs, enabling them to rebuild their margins, increase their investments or cut their prices to enhance their competitiveness. Accordingly, the oil price decline observed since the presentation of the 2016 Budget Bill in September 2015 would account for 0.1 point of additional GDP in 2016 and 0.15 point in 2017.

However, it is possible that the upsides of lower oil prices could become apparent at a different pace than is usually the case. Indeed, businesses still have margin rates below their pre-crisis level and their debt burdens remain high. This could lead them to allocate a larger share of the gains they derive from lower oil prices to savings rather than cutting their prices. On the other hand, households could spend the additional purchasing power from the oil-price windfall more quickly than usual, especially if economic uncertainties dissipate sooner rather than later.