Trésor-Economics No. 164 - Will Africa need a new "Heavily Indebted Poor Countries" Initiative?

The IMF and the World Bank launched the Heavily Indebted Poor Countries Initiative (HIPC) in 1996, and supplemented it in 2005 with the Multilateral Debt Relief Initiative (MDRI). The purpose of the HIPC Initiative was to organise massive relief of external public debt owed to the international financial community as a whole (international financial institutions, official bilateral creditors and private creditors) by countries deemed to be poor and heavily indebted. It was designed to be a permanent solution to the repeated debt crises affecting these countries.

The Initiative is now winding down: only 3 of the 39 eligible countries can still benefit from the Initiative, which makes an assessment both possible and necessary. This issue of Trésor Economics focuses on the 30 African countries that benefited from the Initiative. It aims to describe the impact that the Initiative had on the sustainability of their debt at the time relief was granted, as well as determining the longer-term effects.

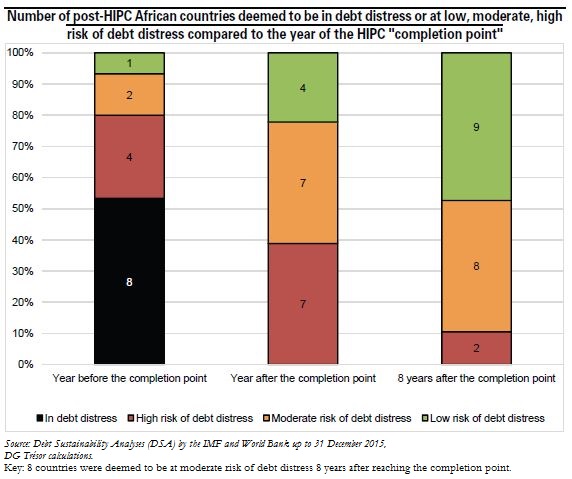

Even though the goal of the Initiative of freeing up fiscal resources in order to start a cycle of inclusive growth (meaning growth that benefits the entire labour force) seems to have been reached, the long-term sustainability of these countries' debt has not been fully assured. Although there is no short-term threat of a fresh debt crisis for the vast majority of the post-HIPC African countries, a few of them have seen a return to burgeoning new debt growth following the Initiative. These countries could soon find themselves with nearly the same levels of indebtedness as before the Initiative. With the end, in 2013, of a period of very favourable exogenous factors (with high commodity prices, demand-driven growth in emerging countries, low global interest rates and a weak US dollar), the sustainability of these countries' debt could deteriorate more rapidly.

Financing sources for the countries under review have also undergone major changes in recent years, both in the case of official sources, with the emergence of new official creditors, and in the case of private sources, with the growing number of sovereign bond issued on international capital markets. The specific structures that most of these countries have used for their sovereign bond issues call for tighter vigilance in particular, since these structures create greater exposure to refinancing risks for the issuing countries.

In the event of a fresh debt crisis, long-standing and more recent creditors' perception of the de facto failure of the previous strategy of massive debt cancellation could make it especially hard to achieve rapid and orderly restructuring of these countries' debt.