Trésor-Economics No. 163 - Towards a better management of the fiscal stance in the euro area?

Since the introduction of the single currency in 1999, the fiscal policy of the euro area has consisted of the juxtaposition of national fiscal policies, largely irrespective of the overall economic conditions in the euro area. During preparations for the launch of the Economic and Monetary Union (EMU), a case was made for a coordinated approach to develop an appropriate fiscal policy at EMU level. Despite these arguments, however, fiscal governance has focused on exercising mutual monitoring to prevent excessive public deficits. The goal was to adopt a minimum set of common rules so that fiscal policies–which remain a national responsibility–would not hinder the fulfilment of the monetary policy mandate, namely ensuring the price stability, which is essential to the proper functioning of the monetary union.

In addition to the objective of financing public goods, fiscal policy can also serve as an economic stabiliser. Spillover effects of national fiscal policies make a case for a comprehensive and consolidated assesment of the fiscal stance at euro area level.

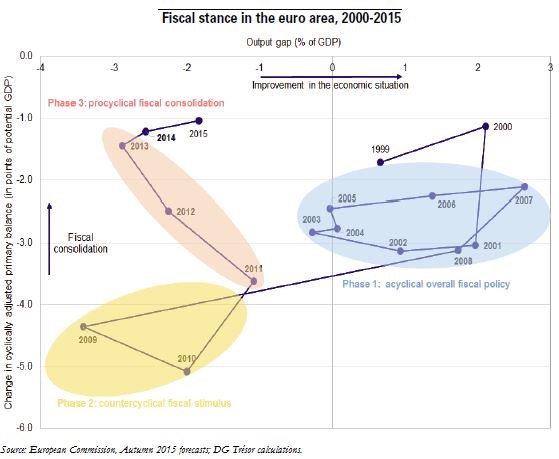

The fiscal stance at EMU level has proved relatively insensitive to the economic cycle for most of the single currency's first 15 years. By and large, the playing of national fiscal policies and of the rules of the Stability and Growth Pact (SGP) proved to be acyclical until 2007 and did not create room of manoeuvre at the top of the cycle. As a result, fiscal buffers were relatively weak in the run up to the crisis. After a brief period of countercyclical stimulus in 2009, fiscal policy became largely restrictive and procyclical from 2011 to 2013, in order to restore confidence in public finances.

In 2011-2013, despite the existence of manoeuvring room with respect to the recommendations of the Stability and Growth Pact (SGP), consolidation severely constrained euro area growth. A more "top-down" approach to SGP implementation could have made more allowance for the effects of Member States' fiscal policies on the area's economy, which were particularly strong during the crisis. This would have fostered the emergence of an aggregate fiscal policy better suited to the cycle.

We seek to promote an aggregate perspective of the fiscal policy, in compliance with the current treaties and legislation underpinning the SGP. We thus propose a change in the calendar of the European Semester that would assign a central role to the Council's recommendation for the euro area. The recommendation–now realeased at the start of the European Semester-would quantify the desirable aggregate fiscal stance. Depending on their status in the SGP, all euro area Member States-including those enjoying some room of manoeuvre within the Pact–would be invited in their country-specific recommendation to perform a fiscal adjustment compatible with the attainment of the desired aggregate fiscal stance. This would foster a more symmetrical approach to the Pact.