Trésor-Economics No. 161 - The new rules for Official Development Assistance loans: what's at stake?

In December 2014, the High-Level Meeting of the OECD's Development Assistance Committee (DAC) approved a major reform of Official Development Assistance (ODA) loan reporting rules–the first change in over 40 years. This was a significant contribution by the OECD ahead of the international meetings held in 2015: the Addis Ababa conference on financing for development in July, and the adoption of new sustainable development goals (SDGs) in September in the context of the United Nations 2030 Agenda for Sustainable Developpement.

The assistance reporting method will now be more consistent. Loan financial flows will no longer serve to determine donors' ODA figures. Donor effort will be measured only by the "grant equivalents" of loans, on top of outright grants. Previously, all loans with a grant element exceeding 25% could be fully reported as ODA, irrespective of their financing terms. The earlier system therefore had two major flaws: (1) a threshold effect (reporting when the grant element exceeded 25%), and (2) ODA variations determined by donors' loan cycles.

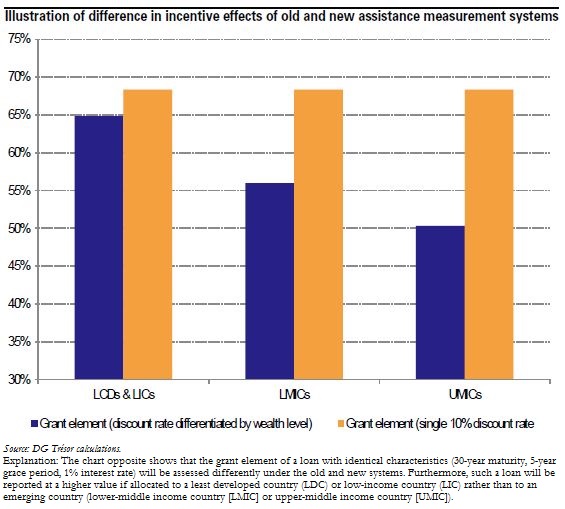

To measure the "grant equivalent" of loans in the new system, the chosen reference–i.e., the "discount rate"–will no longer be uniform but will depend on the recipient country's income level. The wider the spread between the loan interest rate and the discount rate, the greater the loan's "concessionality". The former reference–the 10% discount rate–is abolished.

The discount rate will now be higher when the recipient country has a low income level. It will range from 6% for an emerging country such as China or South Africa to 7% for a country such as Guatemala or Nigeria, and 9% for the poorest countries. For the same loan, the proportion recorded as assistance will thus be larger for a country with little or no access to market financing (see chart below). This approach recognises the donor's risk exposure and hence its financial effort.

For the first time, the DAC has explicity linked its loan policy to compliance with IMF and World Bank rules for sustainable debt. Loans that do not comply with these rules will not be classified as ODA. Moreover, the assistance eligibility conditions have been tightened considerably for the poorest countries, with an increase in the minimum grant element from 25% to over 45%.