Trésor-Economics No. 159 - Access to financing for French VSEs

Very small enterprises (VSEs), which make up 96% of French businesses, fare en essential component of the French economy. They are the main local economic driver, cross-cutting a wide range of sectors, including retailers, crafts and tradespeople, self-employed professionals, service providers, accommodation and food services. They are also present in manufacturing and information and communications technology (ICT). Although at first glance the VSE ecosystem appears straightforward, a closer look reveals greater complexity. VSEs cover a very wide range of businesses, encompassing three million companies with diverse profiles across different sectors and legal statuses, and boasting varying levels of employment and growth.

VSEs' contribution to the economy in 2013 in the main non-farm market sectors may seem modest, providing 17.1% of added value, 18% of salaried employment and 14.7% of investment. But behind these figures lies a more mixed story. Their contribution to employment is underestimated due to the large number of self-employed persons. VSEs did however play a significant role in those sectors where they are traditionally more prevalent, i.e. personal services, accommodation and food services, and the construction industry.

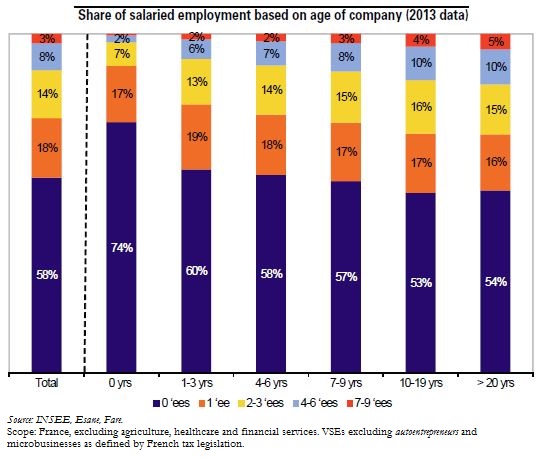

Most VSEs are small: some 60% (excluding autoentrepreneurs, a simplified entrepreneur scheme) do not boast salaried employees and the number of employees increases only very gradually with the age of the company. Job creation is an important issue. VSEs' recruitment plans are strongly related to their growth targets. In addition, staff numbers depend on a range of economic and non-financial factors that vary depending on the company's strategy. While there appears to be a certain degree of reluctance to hire new staff, a small section of the ecosystem stands out due to the significant growth momentum it is enjoying; this in turn has a positive knock-on effect by feeding into the various layers of the economy.

The VSE landscape is constantly changing on the one hand and relatively stable on the other. Many new businesses are starting up, but many others are closing down. Furthermore, VSEs established during the recent financial crisis have reported a greater number of bankruptcies. The weakening of this type of business in the wake of the financial crisis has raised questions as to whether or not VSEs have access to sufficient funding during tougher economic times. They appear to have sufficient access to investment loans and this does not seem to have a negative impact on their capital expenditure projects. By contrast, the results of a survey on their access to lines of credit paint a different picture. However, our interpretation of these results must take into account the company's financial situation ; for example, the survey revealed that 17% of VSEs are in a very difficult financial position.

To avoid putting a strain on short-term cash flow, VSEs can opt for other funding options such as pre-financing of the CICE (competitiveness and employment tax credit). A new, more suitable factoring service could offer a solution to certain business-to-business sectors. At the same time, company managers must enhance their financial knowledge to boost their companies' access to the loan products provided by retail banking networks.