Trésor-Economics No. 158 - Specialisation trends in major advanced countries since the 1990s

With a faster decline of industry as a share of GDP, France's productive structure has been diverging from that of countries with the highest specialisation in industry such as Germany and Japan-a trend accentuated by the 2008 crisis. Conversely, France's growing specialisation in services has brought its productive structure closer to that of the United Kingdom and United States.

As the economic downturn impacted certain sectors more severely than others in 2000-2011, the French industrial base is becoming more specialised and shrinking at the same time. Owing to the decline in the automobile sector and, to a lesser extent, in electrical and optical products, industrial production has concentrated on (1) low and medium-low technology sectors such as manufacture of food products and beverages and metal products, and (2) on high or medium-high technology sectors such as aeronautics and machinery and equipment. However, even the sectors that had resisted rather well-such as the chemical and pharmaceutical industries-appear to have weakened slightly since the 2008 crisis.

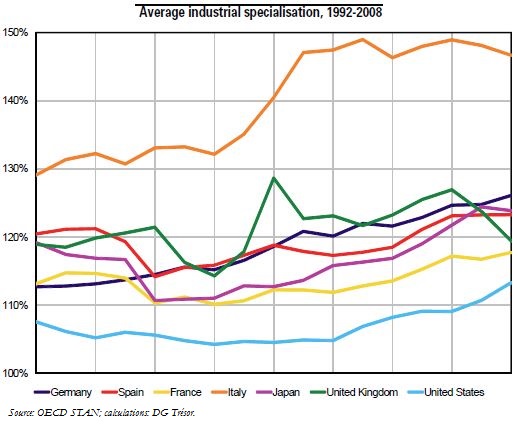

Specialisation, has increased in recent years in most of the countries studied-most notably in the euro area after the adoption of the single currency.

While France has strengthened its trade specialisation in the leading export sectors (manufacture of food products and beverages, chemicals, pharmaceuticals and aeronautics), its trade position in medium technology sectors-particularly the automotive industry-has weakened. The trade specialisation indicator underscores France's similarities with the United Kingdom in terms of specialisation in aeronautics and pharmaceuticals, and with Spain in manufacture of food products and beverages. By comparison, Germany displays a more generalist export profile, including in medium-technology products such as automobiles, machinery and equipment and electrical and optical products, for which French specialisation has declined.

The combined analysis of trade and industrial specialisations highlights the role of comparative advantage as a driver of change in industrial specialisation. In France, weak export performance appears to have quickened the decline in the automotive industry, electrical products and textiles, whose share of industrial value added has been reduced by the loss of export market share and competition from imports. By contrast, some high-performing export sectors such as manufacture of food products and beverages, pharmaceuticals and aeronautics are increasing their share of French industrial value added.