Trésor-Economics No. 153 - The world economy in the summer of 2015: emerging economies expected to slow global growth in 2015

In early 2015, global economic growth slowed, with major disparities between economic areas. The advanced economies continued expanding, albeit at a slightly slower pace than at the end of 2014, but the outlook remains positive. In contrast, growth slowed more sharply in the emerging economies.

In the United Kingdom and the United States, growth picked up again in the second quarter, after a temporary dip in the first quarter. This strong performance confirms the scenario in which surging domestic demand boosts these economies and they continue to outstrip their potential growth rate. In Japan, growth rebounded in the first half of the year, despite a tumble in the second quarter. Japan's growth rate should recover over the forecast period, after posting a negative rate in 2014.

The recovery in the euro area is gathering strength, with growth rates varying from one country to the next. Growth was bolstered by a weaker euro, the big drop in interest rates stemming from the ECB's quantitative easing programme and a slower pace of fiscal consolidation. Germany's growth could be driven by sound domestic factors, even though it was disappointing in the first half of the year. Spain's economy continued to expand at a faster-than-expected pace in the first half of the year, and should be sustained by domestic factors and an improving labour market. After shrinking for three years in a row, Italy's economy started growing again in the first quarter, and is now driven by domestic demand.

The emerging economies showed weak growth at the beginning of 2015. The slowdown was more marked than expected in China, while Brazil and Russia experienced major difficulties. India was the only BRIC country to post relatively resilient growth. Emerging economies should see a slight pick-up in growth in 2016, with brighter prospects in Brazil and Russia more than offsetting a continuing economic slowdown in China.

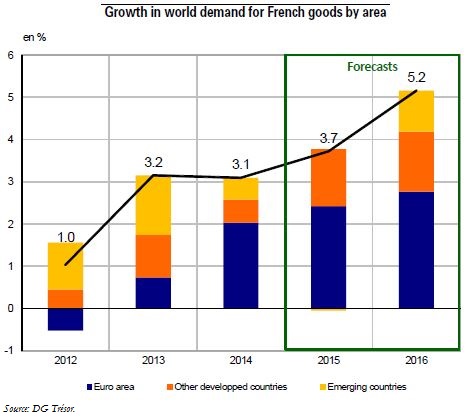

World trade should post slower growth in 2015, as emerging economies imported less in the first half of the year. It should pick up again in 2016, driven by stronger activity in the advanced economies, as well as by import growth in emerging economies that is more in line with their economic growth, after lagging in 2015. World demand for French goods should be less affected by the emerging economies' flagging growth, given the structure of France's foreign trade. This demand should pick up in 2015 and 2016, bolstered by renewed growth in the euro area.

The uncertainties surrounding the scenario balance each other out. There is great uncertainty about commodity prices, particularly oil prices, and exchange rates, which could potentially boost or hamper the growth of the advanced and emerging economies. As China's economy finds a new balance and stock market turmoil affects its growth, the slackening of domestic demand could be more severe than expected. This could be offset by a more assertive response from the Chinese authorities to sustain demand. Finally, a stronger-than-expected recovery in the euro area would greatly improve the prospects for global growth.