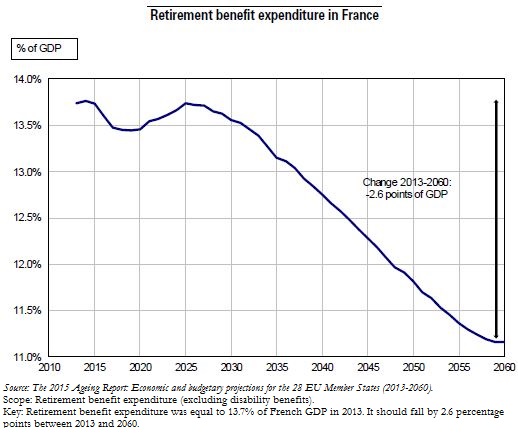

Trésor-Economics No. 152 - French retirement benefit expenditure set to shrink substantially as a share of GDP by 2060, according to European projections

Since 2001, the Ecofin Council gave a mandate to the Ageing Working Group (AWG) made up of the Commission and the Member States to update periodically harmonised projections of age-related public expenditure and other expenditures linked to the sustainability of the Member States' public finances (retirement and disability benefits, health care, long-term care, education and unemployment benefits). The retirement benefit expenditure figures for France were produced by the Directorate General of the Treasury and the National Statistics Institute (INSEE) using the Destinie microsimulation model, based on the demographic and macroeconomic assumptions set out by Eurostat and the Ageing Working Group.

The reforms introduced over more than 20 years should lead to substantially shrink the retirement benefit expenditure as a share of GDP between 2013 and 2060, falling by 2.6 points. This puts France in a generally favourable position compared to its European partners when it comes to coping with its ageing population. In international comparisons, the only expenditure data published are the aggregate figures for retirement benefits and disability benefits, corresponding to the "pensions" component. By 2060, pension expenditure should shrink by 2.8 points of GDP in France, whereas it is expected to remain stable in the euro area, and even increase in some countries (Germany: +2.7 points of GDP between 2013 and 2060, Belgium: +3.3 points of GDP). In 2060, France's expenditure on pensions (retirement benefits and disability benefits), at 12.1% of GDP, will be slightly lower than the average of 12.3% for the euro area.

The Pensions Advisory Council (COR) henceforth updates its projections on an annual basis, and they serve as a benchmark in France. The latest projections, from June 2015, show a smaller decrease in expenditure on retirement benefits as a share of GDP between 2013 and 2060, with a contraction of 1.3 points of GDP (B scenario). Two factors relating to the demographic and macroeconomic assumptions account for the larger contraction in the AWG projections. On the one hand, the AWG projection is based on demographic assumptions that are more favourable for the sustainability of public finances. On the other hand, the AWG scenario calls for smaller productivity gains from 2020 to the middle of the 2030s and a higher unemployment rate starting in 2020, which means that people accumulate lower pension entitlements during that period. This then reduces the expenditure on retirement benefits as a share of GDP at the end of the period covered by the projections.