Trésor-Economics No. 151 - How closely do business confidence indicators correlate with actual growth?

There is a close link between economic growth and the business confidence indicators published by the three organisations that conduct economic surveys in France (INSEE - the French national statistical institute, Banque de France and Markit). All three surveys have "reference thresholds" expressing the balance of optimistic/pessimistic answers. The INSEE and Banque de France set their thresholds at 100, reflecting a long-term average value; the Purchasing Managers' Index (PMI) calculated by Markit has an "expansion" threshold of 50 above which the economy is assumed to be growing. Using simple models, we find that the INSEE and Banque de France 100 thresholds correspond to a quarterly GDP growth of 0.35% since 2000. By contrast, the PMI 50 threshold corresponds to a slightly positive economic growth rate since 2012, and therefore does not reflect an "expansion" threshold. Although these models are solely based on the composite sentiment indicator, their performance are close to more sophisticated models incorporating a lot more information (e.g. all balances of answers to survey questions).

As the correlation between GDP growth rates and survey reference thresholds differ from one country to another, one should exercise caution when using surveys for international comparisons. For example, in Italy, the PMI 50 threshold effectively corresponds, on average, to zero GDP growth. That is not the case in Germany or France, where the 50 balance indicates that the economy is already expanding at a quarterly pace of around 0.15%.

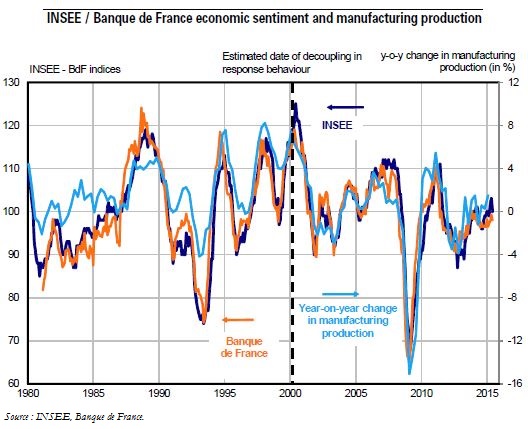

The relationship between economic confidence measured in surveys and actual growth has changed considerably since the early 1980s. From 1980 to 2000, the INSEE and Banque de France reference threshold correlated with an average quarterly GDP growth of 0.5%. Since 2000, it has generally correlated with 0.35% growth. This shift is especially visible in French manufacturing, where the reference threshold correlated with 0.5% quarterly growth in production until 2000 and has since correlated with zero growth.

The explanations for the shift in the relationship between economic confidence and growth are still very tentative. The decoupling may reflect a slowdown since 2000 in the quality effect, whose strength in the 1990s was due to the dissemination of information and communication technologies. However, without a reliable estimate of the quality effect, this hypothesis is hard to test on a comprehensive basis. The decrease in the growth level associated with the reference thresholds may also be connected with the decline in potential growth during the period.