Trésor-Economics No. 146 - The United Kingdom’s productivity puzzle

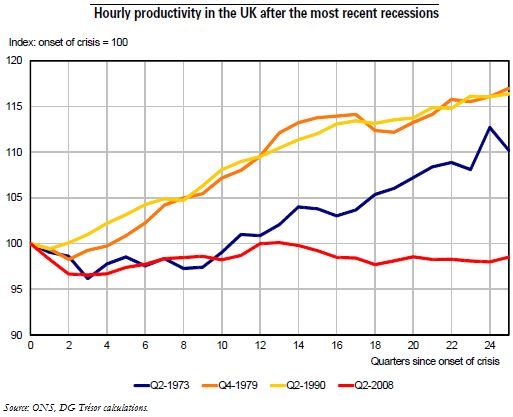

British productivity fell sharply during the 2008 crisis and has barely recovered since then. At the end of 2014, it was still two percentage points lower than in early 2008, and 15 points below the level it would have reached if it had followed its pre-crisis trend growth rate. The UK's persistently low productivity is noteworthy, both from a historical perspective and in comparison to the patterns seen in the other developed countries.

The changing structure of the British economy, with the contraction of employment in the financial sector, one of the most productive ones, explains only a very small part of the productivity shock. Productivity weakened across all sectors of the economy. Similarly, labour hoarding and the increase in part-time and full-time employment do not provide an answer to the productivity puzzle.

Productivity was negatively affected by the higher labour force participation rate of certain groups with lower-than-average productivity, and by the increased capacity of the labour market to absorb them. This concerns older workers in particular, as early retirement packages became less generous and the crisis eroded the value of their retirement savings. It also applies to foreign workers.

Structural drivers of weaker long-term productivity included the lack of investment, impaired capital allocation and the slower pace of technological progress.

The answer to the productivity puzzle is a decisive factor for the policy mix. The productivity growth rate is an important consideration for the Bank of England's forward guidance strategy and for setting fiscal policy.