Trésor-Economics No. 144 - The world economic situation in spring 2015: global activity is accelerating, driven by the advanced countries

Disregarding quarterly fluctuations, GDP growth steadily gained momentum in 2014 in all the advanced economies except Japan. Nevertheless, substantial divergences persist between the main economic areas.

The recovery is forecast to spread to all the advanced economies in 2015, and growth in the euro area should accelerate in 2016. The sharp decline in oil prices is a boost to the global economy. However, less favourable conditions in the emerging countries is something of a drag on world economic momentum.

Economic activity is still buoyant in the United States and United Kingdom, but growth remains sluggish in Japan. Thanks to sustained robust domestic demand, the US and UK economies have expanded vigorously since spring 2014 and should continue to fuel growth in the advanced countries. Japan's economy slowed sharply in the wake of the VAT rise on 1 April 2014. Japanese growth will likely remain slack over the entire forecasting horizon.

Recovery remains uneven in the euro area. The euro's depreciation and the steep drop in interest rates, stimulated by the European Central Bank's Quantitative Easing programme, should sustain business activity in the area. Germany's economy rebounded strongly in Q4, with business investment and private consumption looking set to remain vigorous. The Spanish economy continued to expand. As in other euro-area economies, the recovery in Spain-after the deep correction induced by the crisis-will probably continue to be fuelled by domestic factors, amid an improvement in the labour market. By contrast, the Italian economy contracted for the third consecutive year. The Italian recovery is expected to remain very weak, with investment unlikely to pick up before 2016.

The emerging economies, on the whole, recorded slack performance, reflecting the slowdown in China, major economic difficulties in Brazil and even more so in Russia, which is predicted to slip into recession as a result of lower oil prices and international sanctions. India's relatively brisk growth sets it apart from the other BRIC countries. Thus, emerging economies are expected to post slightly higher growth rates in 2016, but will remain well below the pre-crisis average.

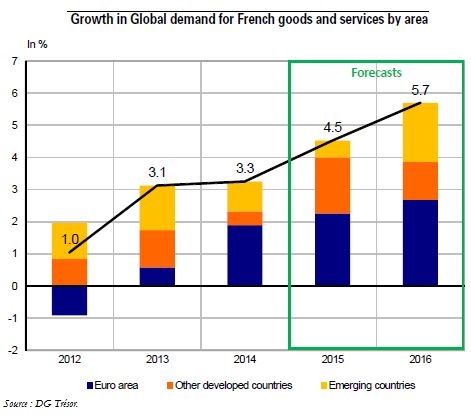

World trade is poised to accelerate in 2015 and 2016, owing mainly the solid performance of the US and UK economies and the recovery in the euro area. Global demand for French goods and services is forecast to move on a similar trend, gaining 4.5% and 5.7% this year and next. The trend will be sustained, in particular, by the upturn in growth in France's chief trading partner: the euro area.