Trésor-Economics No. 142 - Children, family policy and taxation: transfers from the welfare and tax redistribution system to families in 2014

Within Europe, France has an especially strong fertility rate with 2.01 children per woman against an average of 1.58 for the European Union as a whole in 2012. Women are also extremely active in the labour market, with a labour force participation rate of 83% of 25 to 54 year-olds in 2012 compared to the EU average of 79%. Although other factors are involved, these figures are often held up as victories for France's bold family policy.

The three main goals of this policy are to provide financial assistance for dependent family members, to help disadvantaged families and to foster work-life balance. In line with these goals, the welfare and tax redistribution system factors in children in a variety of manners. These include family benefits (means-tested or not), taking account of children for tax assessment purposes and to calculate welfare benefits, childcare subsidies and pension premiums.

Before taxes and welfare benefits, families generally have a lower equivalised income than households without children. On average, the equivalised income of one or two-children families is around 11% below that of childless households. For families with three or more children, the gap widens to 26%. Family-oriented measures provided for by the French welfare and tax redistribution system help narrow this inequality in two ways. First, by redistribution from childless households to families (horizontal) and, second, by redistribution from well-off to poorer families (vertical). Differences in equivalised incomes compared to childless households are therefore reduced to 7% for one or two-children families and to 15% for large families. The main beneficiaries are single-parent families and large families. Lastly, the poorest families are given extra support thus cutting the child poverty rate.

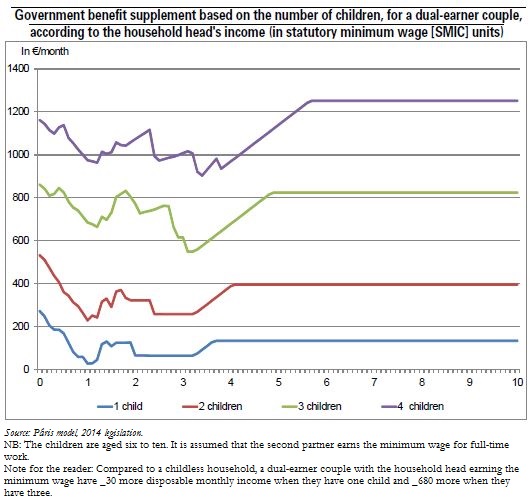

Benefits granted by the welfare and tax redistribution system vary significantly according to the number of children in the family and the parents' income. The child-related increase in disposable income is higher as from the third child, to whom the system attaches great importance. This increase is higher for the poorest and wealthiest households than for middle-income households (see chart below). Recent government initiatives have better targeted the poorest households by lowering the cap on income splitting (quotient familial) which mostly benefits the wealthiest households and by increasing certain means-tested family benefits (family income supplement [complément familial] and family support allowance [allocation de soutien familial]).