Trésor-Economics No. 135 - The world economy in summer 2014: rising uncertainty

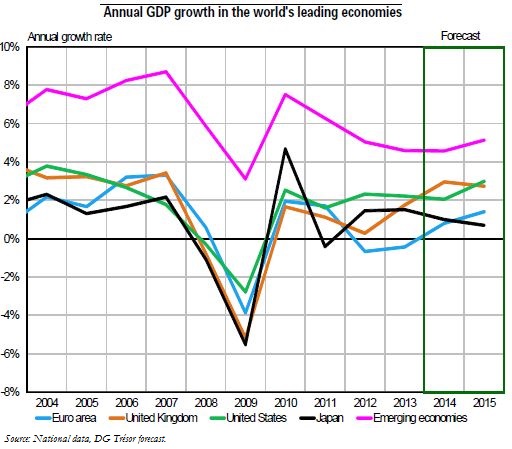

The global economic situation remained weak and uneven in summer 2014. The recovery gathered pace in the Anglo-Saxon countries but has yet to materialize in the euro area and in Japan. Growth in the emerging countries, meanwhile, continued to slow down. While many factors still point to a continuing global recovery, some downside risks have intensified, notably concerning the scale of the emerging countries' slowdown and the crisis in Ukraine.

Activity remains buoyant in the Anglo-Saxon countries, after the dip in the US economy in the first quarter due to an exceptionally cold weather. Strong Q2 figures in both the US and the United Kingdom confirmed their recovery scenarios; while real enough, the weaknesses identified (e.g. the possible formation of another real estate bubble) are unlikely to have any negative short term impact.

The situation in Japan, on the other hand, is more fragile, as the positive effects of "Abenomics" struggle to take firm root, just as the impact of the first VAT increase is starting to be felt. Growth should consequently be subdued in 2014 and should slow further in 2015. However, the economy could receive a boost should the government or the Bank of Japan respond with additional measures.

Recovery in the euro area too remains to be confirmed, after particularly disappointing Q2 figures in several major countries, including a significant dip in activity in Germany (due in part to transitory factors) and Italy. The reduced pace of fiscal consolidation and the still favorable monetary and financial conditions should provide a substantial support to euro area growth. However, the considerable efforts made between 2010 and 2013 are still weighing on activity, while new risks (e.g. geopolitical tensions surrounding the situation in Ukraine) could now cast a shadow on the growth outlook. Looking to the end of the year, the recent deterioration in business sentiment suggests activity could remain persistently weak. The real surprise compared with spring 2014 comes from the drop in inflation to especially low levels. Given this situation and very high unemployment, the euro area's policy mix is open to question.

In the main emerging economies, growth in 2014-2015 is likely to be more sluggish than before the crisis, in China, Brazil and Russia especially. The prospect of rising geopolitical tensions, with Russia in particular, is a major downside risk. One cannot rule out a sharper than expected slowdown in China affecting the commodity exporting countries (e.g. Russia and Brazil), or a revival of financial tensions.

World trade is forecast to pick up very gradually in 2014 (+3.7%) and 2015 (+5.2%), and more slowly than forecast in the spring, while not recovering its pre-crisis growth rate. Global demand for French goods and services is expected to follow a similar pattern, as demand from France's European trade partners recovers only slowly.