Trésor-Economics No. 130 - A spell of deflation in the euro area?

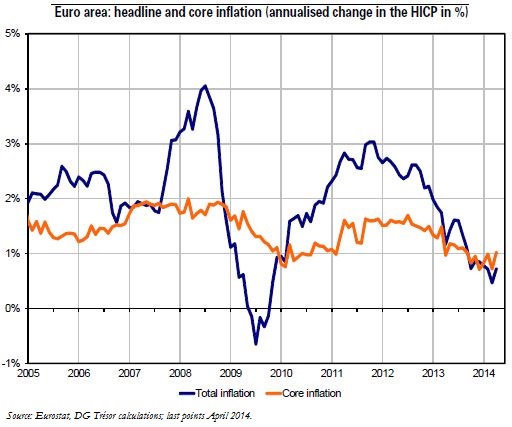

Inflation in the euro area was 0.7% year-on-year in April 2014, after reaching 0.5% in March - its lowest level since November 2009. Inflation began declining in the summer of 2012, due largely to the contraction and subsequent stabilisation of commodity prices, especially oil, as well as the appreciation of the euro. Stripping out the impact of the volatile components of the CPI, core inflation (which excludes energy and the most volatile components) has also declined since the summer of 2012, reaching 0.9% in April.

The current low level of inflation in the euro area strengthens fears of a spell of deflation. Such a scenario would have very adverse macroeconomic effects. Deflation (defined as a sustained drop in prices affecting economic agents' expectations) is characterised by a higher cost of debt in real terms, and even a postponement of investment or consumption decisions.

Some characteristics of the euro area tend to heighten the risk of deflation. In particular, the demand shortfall stemming from private and public deleveraging and the rebalancing through costs initiated by many countries tend to push prices down. The euro area's substantial current account surplus also contributes to the appreciation of the euro, resulting in a reduction in imported inflation and above all a negative impact on exports over time.

The ongoing recovery should lessen disinflationary pressure without eliminating the risk of deflation because of the more distended link between inflation and the business cycle. It is apparent, in the euro area as well in the major developed countries, that inflation has been less sensitive to the cycle since the 1980s, due to central banks' focus on the goal of price stability, as well as the deepening of the globalisation process and policies aimed at eliminating the automatic indexation of wages to prices.

All things considered, (i) providing a broadly more accommodative policy mix for the euro area and (ii) achieving rebalancing through more robust demand in countries with the greatest leeway would help reduce the risk of deflation.