Trésor-Economics No. 126 - The global economy in the spring of 2014: stronger growth, but new risks

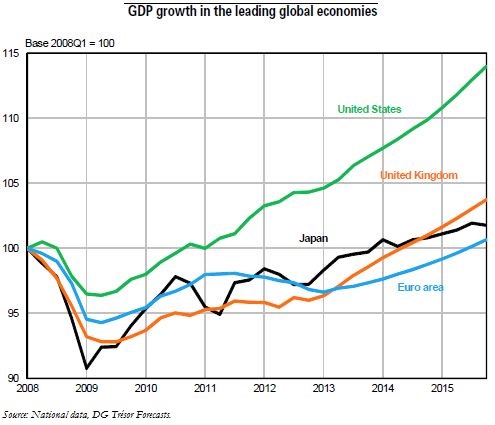

In 2013 global economic growth gradually picked up, but divergences between major economic zones persisted. The growth differential between advanced countries was still stark, with the Anglo-Saxon countries and Japan on one side, and the euro area countries on the other. Growth remained fairly firm in the United States and recovered substantially in the United Kingdom and Japan, on the strength of an accommodative policy mix. Meanwhile, the euro area emerged from one and a half years of recession in the second quarter with a modest recovery that was unequally shared by the different countries, meaning that the euro area failed to post a positive growth figure for the year. This growth gap stems largely from past divergences, such as the overall less accommodative policy mix in the euro area since 2008 and strains on sovereign debt that have been specific to the euro area since 2010. Finally, the growth of emerging economies continued to slow as they were affected by exchange rate fluctuations, capital outflows following the Fed's tapering announcement and their own structural challenges.

At the start of 2014, the earliest available economic indicators pointed to continued global economic growth. Global growth should become firmer in 2014 and 2015, however local growth rates will continue to vary. In the euro area, the recovery that started in 2013 should gain strength and post growth of 1.2% in 2014 and 1.8% in 2015, with the easing of financial tension and less intensive fiscal consolidation. However, growth will still be moderate, featuring persistent wide disparities between Germany, where growth will pick up, and Italy and Spain, which are just emerging from two further years of recession. Growth rates outside the euro area will differ. The Anglo-Saxon countries will continue to enjoy strong economic growth, but Japan's growth will slow as fiscal policy is tightened up. Finally, the growth of emerging economies should continue to be fairly strong, but it will be lower in the longer run than it was before the crisis, particularly in China, Brazil and Russia.

Consequently, the growth of world trade should pick up again, reaching 4.7% in 2014 and 6.1% in 2015. However, it will not match the average growth rate seen between 2000 and 2008. This rebound will boost demand for French exports, particularly the renewed growth in the euro area, which is France's leading trading partner.

This scenario of a gradual improvement in the global economic situation, driven by the developed countries, still faces major risks. In the euro area, as the ECB conducts a comprehensive assessment of bank balance sheets in 2014, the strength of the recovery could exceed expectations if uncertainty is dissipated, but renewed financial tension cannot be ruled out if the assessment goes the other way. The risk of deflation, which is still present in Japan and could threaten certain countries in the euro area, needs to be monitored and underlines the fragility of the current recovery. Finally, the return to more standard monetary policy in the United States is still likely to cause turmoil, not so much in the United States itself as in the emerging countries that are most vulnerable to external shocks.