Trésor-Economics No. 125 - Are business surveys equally successful to forecast economic activity in France?

As the first available economic indicators, business surveys are at the core of short term economic forecasting. However, since mid-2012, business climate indices and composite indicators, which summarize answers given to survey's various questions (about past activity, further prospects, employment etc.), did not move in concert with French growth. Indeed, while French GDP has been quite resilient, business confidence indices from the official statistics office Insee and the Banque de France remain at a low level and the PMI index moves in an area corresponding to a contraction of economic activity.

However, France seems to be an exception: in others euro area economies for which Markit also provides activity composite indicators, no marked discrepancy between economic activity and composite indicators was found.

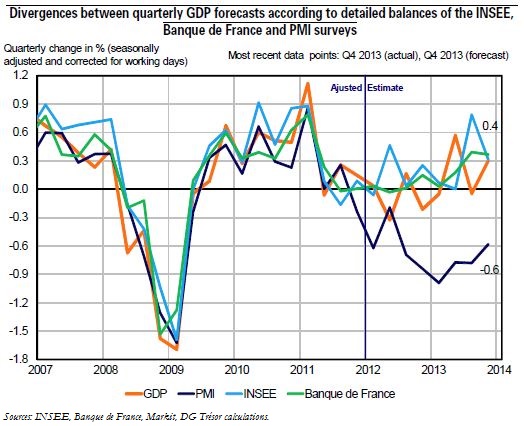

For France, this issue of a clear dropout between indicators and current economy is weaker when using detailed figures of surveys. Thus, forecasts based on detailed figures of Insee or Banque de France surveys still succeed in assessing economic growth, while those based on PMI indices currently seem irrelevant (see chart below).

Better performance of INSEE and Banque de France surveys to provide short term forecasts could be linked with the sample size of the survey: while Insee or Banque de France questions about 10 000 firms, the PMI's sample is ten times smaller.