Trésor-Economics No. 119 - The world economy in the summer of 2013: "the sun is rising in the West"

The majority of the advanced economies experienced stronger growth in the third quarter of 2013, whereas there were growing signs of a slowdown in the emerging economies. Business confidence improved on both sides of the Atlantic, leading the Federal Reserve to announce in June a tapering of its quantitative-casing programme in the coming months, ratcheting up tension on the financial markets once again. And yet, the firmer economic growth seen in the United States and the United Kingdom in the first half of 2013 should continue, since economic indicators remain favourable. Japan's economy is maintaining a sustained rate of growth, stimulated by highly expansionary economic policy since the beginning of the year. In the euro area, improved conditions, or, at least, a slowing of the general decline, have brought an end to the recession. On the other hand, growth is softening in the emerging economies, with China in the forefront, bearing out the signs pointing to slower growth seen since the second quarter.

In 2013, global growth is expected to remain soft, close to the rate registered in 2012. The euro area's economy should shrink again as a result of the many obstacles to growth: the continuing major deleveraging efforts in the public and private sectors and problems with financing the economy, particularly in the southern countries. Growth in the rest of the world should continue to be stronger. The United States should see continued moderate growth curbed by fiscal consolidation measures. In Japan, growth should be driven by the country's very expansionary monetary and fiscal policies. Growth in the emerging economies are expected to be close to the rate seen in 2012, which is still much lower than the prevailing growth rates seen before 2008.

In 2014, global economic growth should pick up slightly, due to stronger growth in the United States and, most importantly, a recovery in Europe stemming from a smaller fiscal effort. The gradual removal of obstacles should enable the euro-area economy to take off again, but its growth is expected to be moderate and subject to significant disparities. Germany's private-sector demand should boost growth, owing to favourable fundamentals, but growth in Spain and Italy should still be held back by problems with debt reduction and/or financing of the economy. Growth of euro-area exports should be driven by the rebound in world trade and boosted by businesses' improved export performance. In the United States, growth should gather strength as private demand becomes firmer, fiscal consolidation measures start to ease and households continue to make good progress on reducing their debt. In the United Kingdom, growth should also be stronger, driven by the improving international environment. In contrast, Japan's growth should slow as a result of a massive fiscal consolidation effort following the fiscal stimulus in 2013 and the hike in the consumption tax. Finally, the emerging economies should continue to see relatively weak growth compared to the first decade of the new millennium.

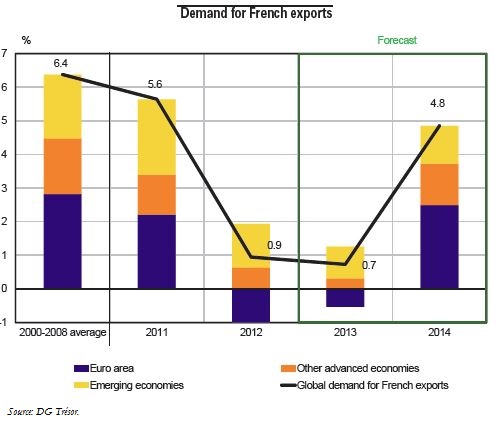

After remaining slack in 2012 and 2013, world trade should pick up again in 2014 (5.25%), driven by the expected recovery in the euro area and the rest of the world. Demand for French exports is likely to follow the same pattern.

The improvement in the global economy could be swifter if the surplus savings of those countries enjoying some leeway were put to use. However, an abrupt end to unconventional monetary policy in the United States, a sharper slowdown of the emerging economies, or an increase in geopolitical tensions in the Middle East could undermine the current recovery.