Trésor-Economics No. 115 - Consolidation without devaluation: does it work?

For countries experiencing a balance of payments crisis or running an excessive current account deficit, devaluing the nominal exchange rate can offer a quick return to competitiveness. However, this option is not available to countries belonging to a monetary union or with a fixed exchange rate regime in place (i.e. that have pegged their currency to a reference currency) without jeopardising said system.

Between 1980 and 2010, thirty-eight adjustments to the current account balance of over 5 GDP percentage points were identified in thirty-two countries with either a fixed exchange rate regime or that were members of a monetary union.

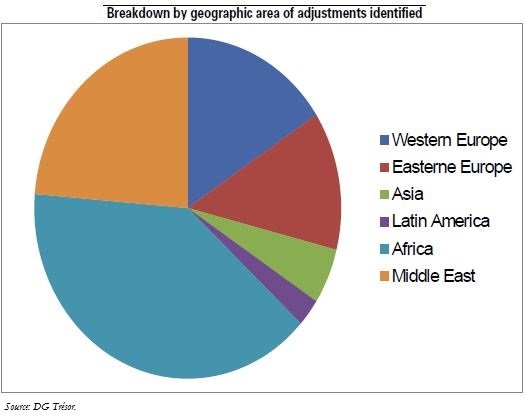

The sample of countries varies widely in terms of geography and includes both developed and emerging economies. The duration and size of the adjustments identified varied from country to country.

After stripping out those countries that enjoyed particularly buoyant conditions, two diametrically opposed types of adjustment emerged based on the factors identified: contrained adjustments carried out as a result of market pressure (with public and private economic agents reducing their demand for credit due to tougher borrowing and lending terms) and autonomous adjustments made against a background of moderate market pressure and the political will to boost a country's competitiveness and exports.

In the majority of cases, external factors (improved terms of trade, depreciation of the reference currency, upturn in global demand and transfers) played an important role in bringing about the adjustment.