Trésor-Economics No. 114 - Why the GDP growth «gap» between the United States and the euro area?

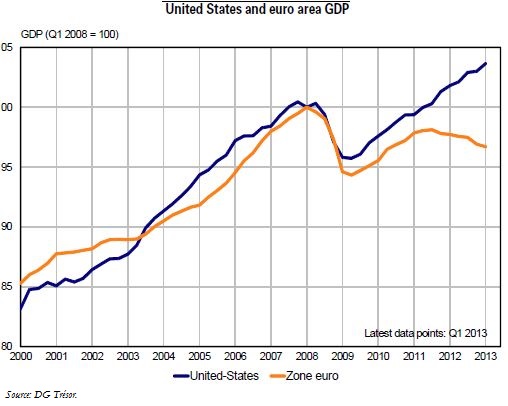

Since the sovereign debt crisis in the euro area intensified in the summer of 2011, the growth paths of the United States and the euro area-which were closely linked beforehand, even during the crisis-have been diverging. In 2012, U.S. growth held firm at 2.2%, whereas the euro area slipped into a new recession, with GDP growth in negative territory at – 0.6%. This divergence is mainly due to the relative vigour of U.S. private-sector growth engines. In the euro area, by contrast, only one factor can cushion the economic downswing: foreign trade.

The U.S. economy has weaker automatic stabilisers and a more flexible labour market than the euro area, which explains its generally wider cyclical swings and justifies the use of more responsive macroeconomic policies. During the 2008-2009 crisis, the United States experienced a milder contraction than the euro area thanks to a more substantial stimulus package. However, the adjustment in employment and wages was greater in the United States, preserving the financial position of businesses.

Another important factor in the current divergence is the policy mix. In 2011-2012, the fiscal consolidation was milder in the United States than in the euro area, where it intensified during the sovereign debt crisis owing to the constraints of fiscal rules and pressures from financial markets. Moreover, the U.S. adjustment has been gradual and is taking place amid an economic recovery. In the euro area, by contrast, fiscal consolidation plans largely concern the weakest countries, where private demand is adjusting in a context of balance sheet adjustments. As a result, the plans are generating crosswinds due to the strong commercial ties among EU Member States. Because of financial fragmentation, the private sector's access to funds is harder in the euro area than in the United States, particularly for the most troubled countries.

In the years ahead, however, the divergence may narrow. Financial conditions in the euro area have distinctly improved since summer 2012, thanks to the measures implemented by the European Central Bank (ECB) (including the announcement of outright monetary transactions [OMT]), and the announcement of the creation of a single supervisory mechanism-the first step toward a banking union. The efforts still needed to cut the public and current-account deficits are greater in the United States than in the euro area. Over the medium term, U.S. public finances are in a weaker structural position than those of the euro area.