Trésor-Economics No. 113 - The Shadow Banking System in the United States: Recent Developments and Economic Role

The shadow banking system (SBS) is made up of a multitude of banking and financial operators linked to each other by financial intermediation chains of varying lengths and degrees of complexity.

At one end of the financial intermediation chain, deposits are taken from non-financial investors, in the form of shares in money market mutual funds, for example. At the other end of the chain, loans are distributed to these investors.

Therefore, the shadow banking system performs the financial intermediation function in the same way as the traditional banking system. The main distinguishing characteristics of the shadow banking system are looser supervision and greater fragmentation between operators at each link in the intermediation chain.

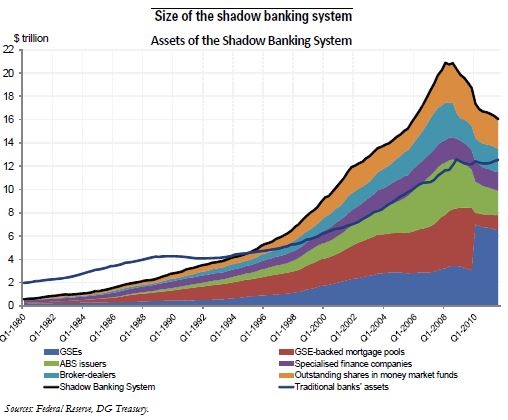

The shadow banking system underwent substantial growth in the United States after 2000, with total assets peaking at $21 trillion in the third quarter of 2008, which is equivalent to 145% of the country's GDP. After the financial crisis, the SBS, as measured by the sum of the balance sheet assets of the players in the system, contracted by nearly one quarter.

This contraction was the result of a decline in some of the shadow banking system's main lines of business, such as mortgage securitisation, as well as increasing difficulty in accessing financing, as markets revalued risks.

This decrease in the size of the shadow banking system coincided with a sharp contraction of its share in the financing of the United States' real economy. This share is difficult to gauge, but it is estimated to have shrunk from 41% to 31%, depending on the method used, or from $16 trillion to $12 trillion from its peak in the third quarter of 2008.

This decline of the shadow banking system's share of financing for the economy went hand-in-hand with an increase in the demand for short-term investments, stemming from American companies' growing cash reserves. However, this demand was met by alternatives to the short-term securities that are traditionally issued by the shadow banking system and, more specifically, by commercial paper issued by the federal government.

Supervision of the SBS was supposed to be tightened up under the Dodd Frank Act passed in July 2010, which has been progressively implemented by American regulatory agencies.