Trésor-Economics No. 112 - The world economy in the spring of 2013: a brighter outlook?

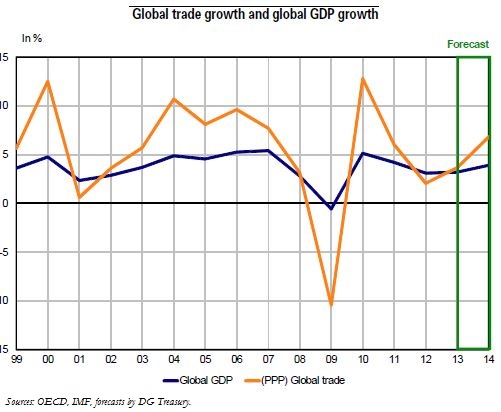

At the end of 2012, international trade and global economic growth stalled, partly because of temporary factors. The main reason growth remained flat in the United States was the fall in military spending and the impact that hurricane Sandy had on output and inventories, which cancelled out the growth of private expenditure. The dip in the United Kingdom's fourth-quarter growth offset the stronger third-quarter growth, which had benefited from the London Olympics. In the euro area, growth slowed more sharply in the fourth quarter than in the third quarter, which is somewhat surprising given the gradual easing of financial tensions over the period. However, some temporary factors affecting the euro area's main trading partners and trade within the euro area held growth down. These factors include the increase in indirect taxes in Spain and the Netherlands and the decline in automotive production in Germany.

The preliminary data for the beginning of 2013 point to an improvement in global growth that is still fragile. Confidence is on the rise. In the United States, the improvement stems from the resolution of major budget issues that preventing the country from going over the fiscal cliff and, in the euro area, the improvement can be attributed to the combined action of Member States and European institutions, and, more specifically, the European Central Bank.

The outlook for 2014 is for gradually stronger growth of the advanced economies, but is still will not as strong as before the crisis and large disparities will persist. This return to growth, which hinges on eliminating uncertainty, will be driven by stronger private sector growth in certain advanced economies, and primarily the United States, and against the backdrop of lessening fiscal consolidation in the euro area. Growth disparities will stem from persistent obstacles to growth in certain euro area countries, such as process of reducing the debt of households, businesses and general government, and/or structural weaknesses.

Disparities will also stem from the greater progress achieved in the United States in reducing private debt and the recovery of the real estate market, and from Japan's continuing expansionary fiscal policy. The strong growth of emerging economies, and China in particular, should sustain the recovery of the advanced economies via the trade channel.

There are also threats to growth. The driving force from the private sector could be less powerful than expected, particularly in the United States and Germany, because of the relatively comfortable situation that companies enjoy in these two economies. On the other hand, a return to enduring financial tension in the euro area would prolong uncertainty and could hamper the recovery. The global economic situation is also dependent on changes in economic policies.