Trésor-Economics No. 111 - How should one assess short-term economic uncertainty?

Economic activity in the major European Union countries and the United States has been heavily affected on several occasions since 2008 by the decline in confidence among economic players. Uncertainty in the financial markets, measured by market volatility indexes or government-bond spreads, rose sharply in the summers of 2011 and 2012.

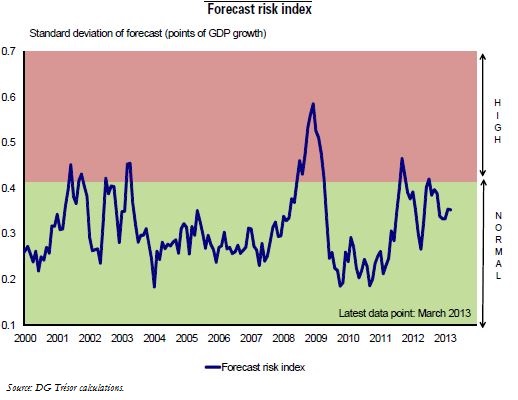

In cyclical turnarounds, short-term economic growth is often hard to forecast with standard models, which consist of calibrations on business surveys. These models heavily underestimated the probability of very wide swings in quarterly growth at the start and end of the 2008-2009 crisis.

This issue describes an alternative model based on quantile regressions, which captures uncertainty in real time.

It allows a monthly assessment of the combined effects of business-climate changes and financial-market pressures not only on economic activity but also on business-cycle uncertainty.

The model identified an uncertainty peak in July 2012. Since then, uncertainty has gradually declined-a trend probably correlated with policy-makers' response to the euro area sovereign-debt crisis.