Trésor-Economics No. 109 - Asia in 2020: growth models and imbalances

Asia has been by far the most dynamic region of the world over the past decade, powered most notably by China's rapid growth, to the point where it now accounts for more than two-thirds of world growth.

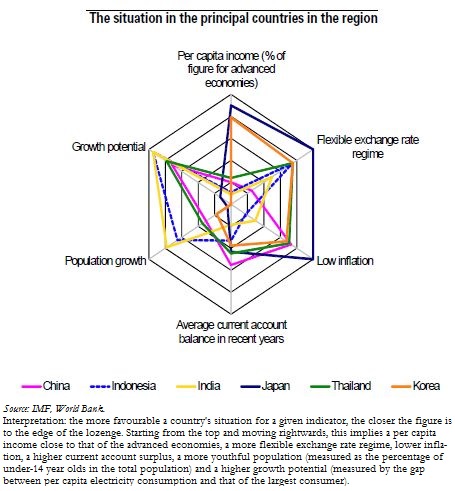

In most Asian countries, income levels are progressively converging with those of the advanced economies, and these countries are developing their physical and financial infrastructure. Considerable essential basic needs remain unfulfilled, and this should help to fuel continuing growth between now and 2020.

Growing regional integration is another feature of this process. This integration primarily concerns trade, through regional agreements and bilateral free trade treaties boosting the share of intra-zone trade, partly with the emergence of global production chains and the specialisation of some countries in logistics. But the integration is also financial, with the growth of domestic, local currency-based financial markets.

The Asian countries' growth model is largely based on their external surpluses, which result in part from policies supporting their export sectors. These accumulating surpluses, in a context of imperfectly flexible exchange rates, account for the bulk of the expansion of global currency reserves.

In most Asian countries, very high levels of national savings go hand in hand with a relatively low investment rate. The latter will need to rise, in order to pay for the spending on infrastructure and education required to sustain these countries' growth potential.

The situation in China and Vietnam is somewhat different: investment has risen but has become less productive in recent years. Ultimately, China will have to rebalance its model in favour of consumption, as the population ages. More immediately, one cannot rule out a crisis scenario triggered by domestic debt and the rapid growth of the property sector.