Trésor-Economics No. 108 - The shortage of international trade finance during the 2008 crisis: findings and perspectives

International trade finance facilitates more than 80% of flows of trade in merchandise, and is central to the smooth functioning of world trade at a time when manufacturing processes are fragmented across many different countries.

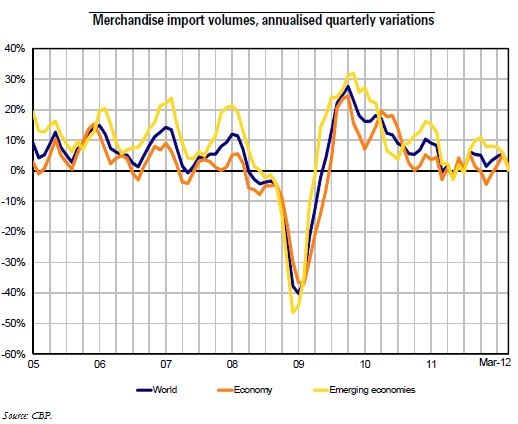

In 2009, trade volumes declined for the first time since 1982, as a result of the economic and financial crisis. One of the explanations advanced to account for this contraction, apart from weaker global activity, is the reduced availability of trade finance, itself a consequence of a worldwide dearth of liquidity and of a sudden, steep rise in risk aversion in the markets between the end of 2008 and the beginning of 2009.

When risk aversion does rise sharply, trade finance, traditionally seen as a low-risk activity, is subject to especially heavy discrimination because the parties concerned are located in different countries, and because it frequently concerns short-term (less than 90 days) dollar-denominated transactions, which imposes hefty capital charge on the banks. This situation may advocate internationally coordinated public intervention.

Several initiatives to attenuate the dearth of trade finance were taken in response to the 2008 financial crisis. At the G20 meeting in London, in April 2009, it was decided to make available USD 250 billion of public financing in the form of guarantees or insurance mechanisms, via the multilateral development banks (MDBs) and export credit agencies.

In the developed countries, temporary support via insurance and guarantees or credit facilities provided by the export credit agencies has helped reduce the shortage of trade credit.

Other more structural measures have been introduced recently in order to improve the flow of finance for normal international trade. These measures could subsequently be completed by European Community-level reforms or institutional reforms in the developing countries.