Trésor-Economics No. 106 - Should the monetary authorities react to oil price swings?

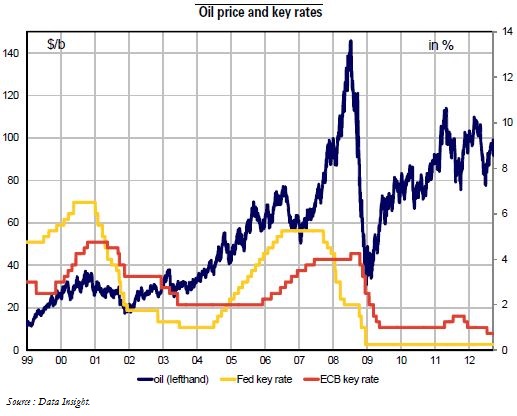

Oil prices have been rising since June of this year, after falling in the second quarter of 2012 against a background of slowing economic activity and increased supply. The price of Brent has risen 50% since 2007, to $115 per barrel in October 2012.

The steep increase in the price of oil in 2008, and again in 2010-2011, has sparked discussion on how the importing countries' monetary authorities might react, given the difficulties of coping with imported inflation, over which they have no direct influence without negatively affecting economic activity.

In theory, the temporary uptick in the oil price does not require any systematic response from the central banks, since the ECB's mission is to maintain medium term price stability, while the Federal Reserve and the Bank of Japan target core inflation. However, oil price swings can affect the formation of rigid prices such as wages. They can also fuel second-round price effects, which, in the current extremely accommodating monetary policy context, could loosen the anchoring of inflation expectations.

In advanced economies, monetary tightening in the name of price stabilisation does not appear to be required as long as inflation expectations remain firmly anchored. This is because our econometric estimates suggest that:

Oil price rises have little impact on headline inflation in the long run, and no impact on core inflation in the United States and the eurozone. Oil prices partly feed through into inflation via wages, but the low probability of rising wages at present reduces the likelihood of second-round effects.

Rising oil prices have a significant, albeit small, impact on inflationary expectations in the United States and in the eurozone. The impact is weaker in the eurozone, which may be due to the stronger probability that the ECB will react in response to an oil price rise, as suggested by past tightening moves (July 2008, and April and July 2011).