Trésor-Economics No. 103 - Does financial globalization affect the external adjustment of national economies?

The net external position (NEP) of a country's economy is the difference between total foreign receivables held by residents and total claims on residents by foreign creditors. An economy with a negative NEP is therefore in debt to the rest of the world. Our study focuses on the adjustment mechanisms that enable an economy to rebalance its NEP.

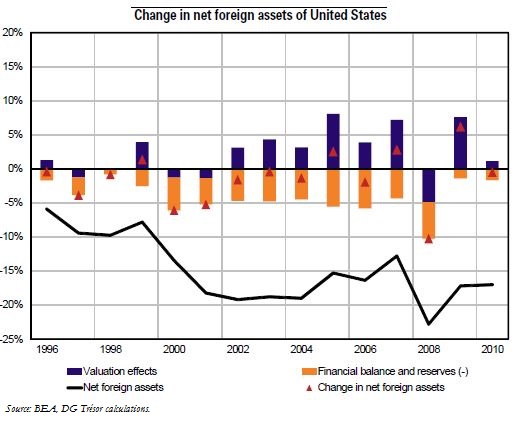

The international financial integration under way since the mid-1990s has intensified cross-border flows of financial securities, causing a sharp increase in countries' external balance sheets. This has made NEPs more sensitive to asset-price and exchange-rate fluctuations-known as "valuation effects"-and partly decorrelated NEPs from current-account movements. The United States, for example, enjoyed substantial valuation effects from the 2000s up to the 2008 economic crisis. Despite the deterioration in its current-account balance, its NEP remained relatively stable thanks to positive average valuation effects (see chart below).

Exchange-rate fluctuations can affect the NEP via two channels. The first is the conventional trade channel: exchange-rate movements influence the trade balance, which in turn impacts the NEP. The second is a financial-adjustment channel, in which exchange-rate movements modify the valuation of external asset and liability stocks. In theory, assuming rational expectations and perfectly substitutable assets, price movements should offset most valuation effects due to the exchange rate.

Econometric analysis shows, however, that the "financial adjustment channel" plays a significant role, for-in developed countries as in emerging countries-variations in asset prices offset only a part of the exchange-rate effects.